Feb 20, 2024

Suitability Analysis of the CME CF Bitcoin Reference Rate - New York Variant as a Basis for Regulated Financial Products - February 2024 Update

Benchmarking the Price of Bitcoin

In traditional markets, price benchmarks are used extensively for a variety of purposes, from settling derivatives transactions, to determining Net Asset Value (NAV) for investment funds amongst a host of use cases in institutional finance. One could almost go as far as saying that the preponderance of the use of a benchmark is a hallmark of the degree to which any market is institutional in nature. Certainly, as asset classes like commodities saw greater participation from financial institutions, benchmarks such as the S&P GSCI became more ubiquitous in that market. The market for Bitcoin trading has, since its inception in 2010, been largely driven by individual investors with a small but increasing stream of institutional participation since 2017, when the first regulated futures contracts were launched by CME Group and CBOE Inc.

Today, there are regulated derivatives contracts from CME Group and Eurex AG, recently approved regulated spot Bitcoin ETFs in the US as well as a variety of other regulated exchange traded products and funds in Canada, Brazil, Hong Kong and Europe. A market at this juncture typically begins to exhibit increased benchmark usage that accelerates participation in the markets for these products by institutions; this process has been accelerated by the recent listing of spot Bitcoin ETFs in the US. Whilst Bitcoin is a novel asset, the requirements of a benchmark price for Bitcoin are no different from those required of a benchmark price for any asset. Whether it be Brent/WTI for crude oil, Term SOFR for money markets, or EuroStoxx 50 for the European equity markets – all benchmarks need to be representative of the underlying market, resistant to manipulation, and replicable by market participants, to be able to foster further institutional participation in the underlying market that is being measured.

When examining any benchmark the first thing to understand is why we benchmark the price of any asset or an asset class. In the case of ETFs the primary purpose of a benchmark is to determine the cash value of the investments held by the ETF so a Net Asset Value (NAV) can be calculated. This facilitates a number of processes that are crucial to the operation of an ETF and serve its investors

- Shares to be created and redeemed at NAV; a consistent and reliable NAV strike across time allows Authorised Participants (APs) to provide reliable secondary market liquidity, resulting in tight spreads for investors that buy or sell the shares

- Measuring the efficacy of the ETF structure and operational skill of the ETF manager; where the chosen benchmark is suitable for the purpose of striking NAV for an ETF then the ETF should track this closely- where tracking error becomes evident then it is symptomatic of either poor structure (ie. poor choice of benchmark) or a deficiency of skills on behalf of the manager

To be able to fulfil the above two objectives a benchmark must fulfil the three Rs; be representative of the underlying market, be resistant to manipulation and be replicable by market participants- especially APs given the role they play in providing liquidity and their ability to create/ redeem ETF shares.

The CME CF Bitcoin Reference Rate – New York Variant

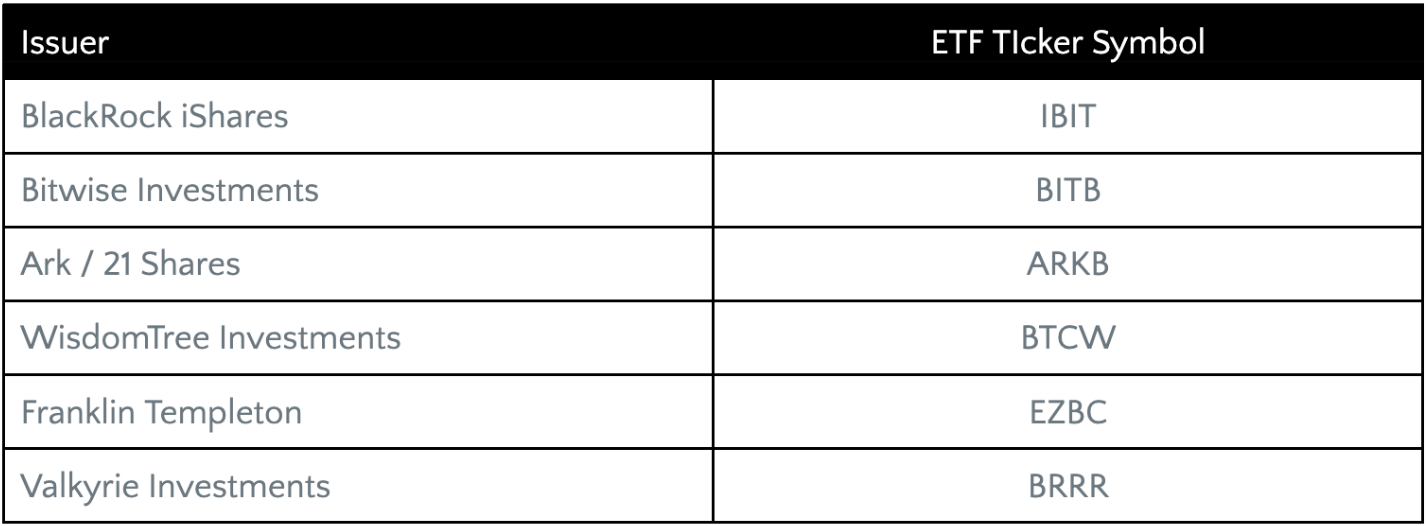

This paper seeks to understand whether those qualities are being achieved by the regulated CME CF Bitcoin Reference Rate – New York Variant (BRRNY), the benchmark for six spot Bitcoin ETFs listed in the U.S. that on aggregate hold Assets under Management of $9.2bn at the time of the publication of this paper1

The BRRNY index is methodologically identical to the regulated CME CF Bitcoin Reference Rate (BRR), the most widely used benchmark price for Bitcoin, that settles the Bitcoin-USD derivatives complex listed by CME Group, and which serves as the NAV for exchange listed investment products from WisdomTree Europe, Evolve ETFs (CAN) and QR Asset Management (BRZ).

The only difference between the CME CF BRRNY and the CME CF BRR, is that BRRNY references the price of Bitcoin at the closing time of U.S. markets, 16:00 New York Time, rather than the price at 16:00 London Time, referenced by the BRR. The purpose of BRRNY is to provide a replicable, manipulation-resistant and representative Bitcoin benchmark that synchronizes with the traditional U.S. market close.The CME CF Bitcoin Reference Rate – New York Variant is a regulated Benchmark under the UK Benchmarks Regulation (BMR) regime.

Calculation Methodology

The BRRNY calculation methodology aggregates transactions of Bitcoins in U.S. dollars that are only conducted on the most liquid markets for which data is publicly available and operated by exchanges that meet the CME CF Constituent Exchange Criteria.

The list of Constituent Exchanges and information about changes to its composition are available at the following URL:

https://docs.cfbenchmarks.com/CME%20CF%20Constituent%20Exchanges.pdf

The full methodology is also available here:

https://docs.cfbenchmarks.com/CME%20CF%20Reference%20Rates%20Methodology.pdf

The methodology can be summarised thus:

- Transactions conducted on Constituent Exchanges are observed during a one-hour window from 15.00 to 16.00 New York Time

- The one-hour window is divided into 12 partitions of equal length (five minutes each)

- For each partition, a volume-weighted median (VWM) is calculated

- The index value is expressed as the arithmetic mean of the 12 VWMs calculated in the previous step

Benchmark validity and volume sufficiency

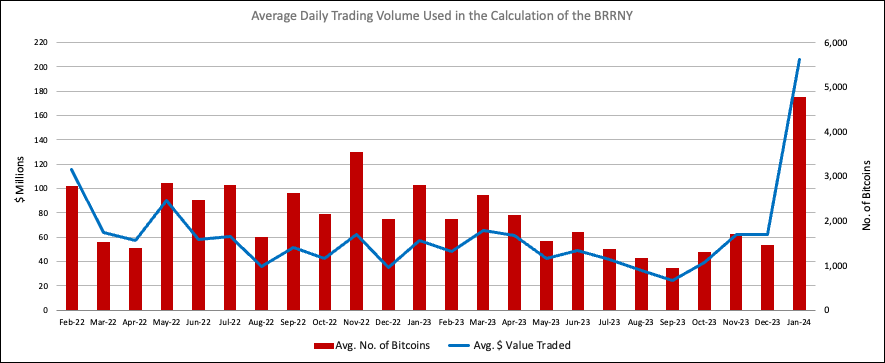

A valid and robust benchmark needs to be calculated from input data of sufficient volume so that it is representative of the market it seeks to measure. From a practical perspective, volume sufficiency is also key in order for the benchmark to be replicated by institutional market participants and product providers that need to warehouse price risk. To understand how the BRRNY measures up, data summarising a total number of transactions and an average number of transactions per day observed each month during the observation window (data represent both trade count and bitcoin volume) are presented in Figure 1.

Note: The BRRNY was launched on February 28th, 2022. LMAX Digital was added as a Constituent Exchange from May 2022

Between February 28th, 2022, and January 31st, 2024 (weekdays only), on average 2,116.73 Bitcoins, or $59M were traded during each daily observation window between 15:00 and 16:00 New York Time. Whilst trading activity exhibits volatility, this volatility is not substantially different from that shown in traditional asset markets. In conclusion, the volume observed and the reliability of that volume are clearly evident to be sufficient for the calculation of a robust and reliable benchmark.

Resistance to Manipulation – Benchmark Integrity

This section will address the question of whether the BRRNY is possessed of integrity in the specific sense applied by securities regulations. The practical imperative is that a benchmark requires integrity because it will be used for a wide range of activities such as asset valuation, settlement of financial risk, risk management, NAV calculation, unit creation and unit redemption. Specifically, the benchmark must both be shown to be free of manipulation and furthermore, it must be administered and calculated in a manner that deters and impedes manipulation.

Deterring and Impeding Manipulation

The methodological design underlying the BRRNY and its system of administration incorporate measures that promote integrity as outlined in the sub-sections below.

Impeding Manipulation by Input Data selection

CF Benchmarks exclusively sources input data from Constituent Exchanges that meet published criteria as set out in its Constituent Exchanges Criteria. The criteria are available at this link: https://docs.cfbenchmarks.com/CME%20CF%20Constituent%20Exchanges%20Criteria.pdf.

Particular attention is drawn to the following statement from the Constituent Exchanges Criteria document (part 2 of Section 3, page 5: ‘Eligibility Criteria’):

“The venue has policies to ensure fair and transparent market conditions at all times and has processes in place to identify and impede illegal, unfair or manipulative trading practices.”

CF Benchmarks ascertains the presence of fair and transparent market conditions and processes to identify and impede illegal, unfair or manipulative practices by conducting a thorough review of any exchange under consideration for inclusion as a Constituent Exchange. The arrangements of all Constituent Exchanges are reviewed annually to ensure that they continue to meet all criteria specified within “Constituent Exchange Criteria”. This due diligence is documented, and the information is distributed to CF Benchmarks’ oversight organs to consider. The deliberations of oversight organs are conducted during regular meetings, minutes of such meetings are publicly available, being published by the Administrator on its website.

Manipulation resistance by design

Resistance to manipulation is a priority aim of the design methodology underlying the CME CF Bitcoin Reference Rate – New York Variant. The methodology takes an observation period and divides it into equal partitions of time. The volume-weighted median of all transactions within each partition is then calculated. The benchmark index value is determined from the arithmetic mean of the volume-weighted medians, equally weighted. The benefits of this process with respect to achieving manipulation resistance are outlined below.

- Use of partitions

Individual trades of large size have limited effect on the Index level as they only influence the level of the volume-weighted median for that specific partition.

A cluster of trades in a short period of time will also only influence the volume-weighted median of the partition or partitions they were conducted in.

- Use of volume-weighted medians

Use of volume-weighted medians as opposed to volume-weighted means ensures that transactions conducted at outlying prices do not have an undue effect on the value of a specific partition.

- Equal weighting of partitions

By not volume weighting partitions, trades of large size or clusters of trades over a short period of time will not have an undue influence on the index level.

- Equal weighting of constituent exchanges

CF Benchmarks applies equal weight to transactions observed from CME CF Constituent Exchanges. With no pre-set weights, potential manipulators cannot target one platform for the conduct of manipulative trades.

- Use of arithmetic mean of partitions

Using the arithmetic mean of partitions of equal weight further denudes the effect of trades of large size at prices that deviate from the prevailing price having undue influence on the benchmark level.

Manipulation resistance by exclusion of input data

A specific procedure for dealing with potentially erroneous data is incorporated into the methodology of the BRRNY. Although volume-weighted medians of transaction prices from individual data sources are not part of the benchmark determination process, they are calculated as a means of quality control and manipulation resistance.

In the event of an instance of index calculation in which a Constituent Exchange’s volume-weighted median transaction price exhibits an absolute percentage deviation from the volume-weighted median price of other Constituent Exchange transactions greater than the Potentially Erroneous Data Parameter (10%), then transactions from that Constituent Exchange are deemed potentially erroneous and excluded from the index calculation. All instances of data excluded from a calculation trigger a Benchmark Surveillance Alert that is investigated.

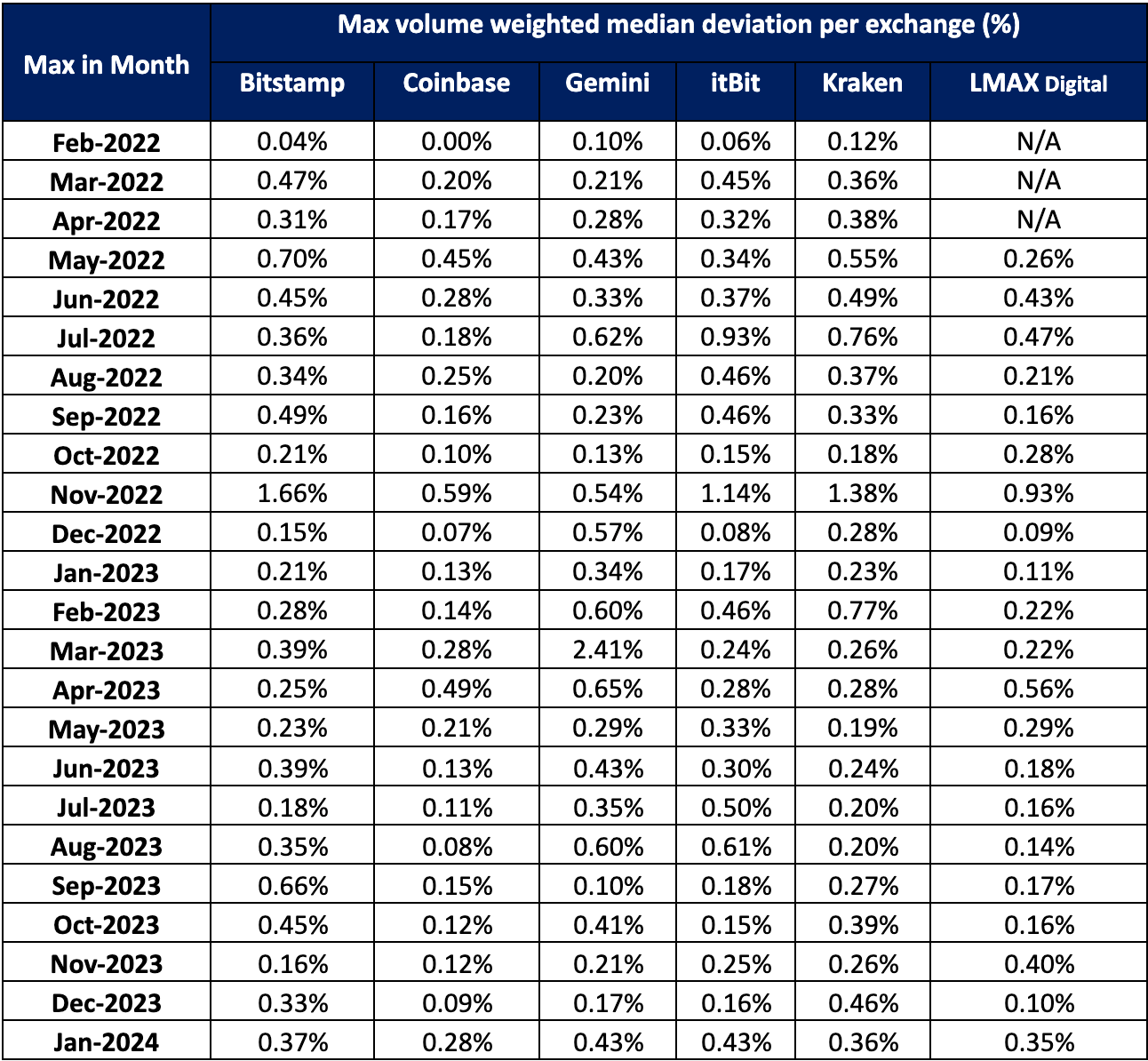

Between February 28th, 2022, and January 31st,2024, the Potentially Erroneous Data Parameter of the methodology for the CME CF Bitcoin Reference Rate – New York Variant has never been triggered. Analysis of the max volume-weighted median per exchange during the observation period produced the results in Table 2. The results illustrate that during the observation period, no Constituent Exchange’s input data needed to be excluded due to exhibiting potential manipulation and indeed no individual cryptocurrency exchange exhibits a deviation percentage above 2.41% during this period.

Note: The BRRNY was launched on February 28th, 2022. LMAX Digital was added as a Constituent Exchange from May 2022

Benchmark Surveillance

Although a series of measures have been undertaken to mitigate the risk of benchmark manipulation, CF Benchmarks remains vigilant against attempted benchmark manipulation and monitors input data continuously. To that end, CF Benchmarks has implemented a benchmark surveillance programme for the investigation of alerts. Instances of suspected benchmark manipulation are escalated through appropriate regulatory channels in accordance with CF Benchmarks’ obligations under the UK Benchmarks Regulation (UK BMR). Regarding benchmark manipulation, Article 14 of the UK BMR, Reporting of Infringements, states:

1. An administrator shall establish adequate systems and effective controls to ensure the integrity of input data in order to be able to identify and report to the FCA any conduct that may involve manipulation or attempted manipulation of a benchmark, under Regulation (EU) No 596/2014.

2. An administrator shall monitor input data and contributors in order to be able to notify the FCA and provide all relevant information where the administrator suspects that, in relation to a benchmark, any conduct has taken place that may involve manipulation or attempted manipulation of the benchmark, under Regulation (EU) No 596/2014, including collusion to do so.”

As a regulated Benchmark Administrator, CF Benchmarks is subject to supervision by the UK FCA. Furthermore, CF Benchmarks’ Control Procedures with respect to compliance with the UK BMR have been audited by ‘Big Four’ accountancy firm Deloitte. The Independent Assurance Report on Control Procedures Noted by CF Benchmarks Regarding Compliance with the UK Benchmarks Regulation as of 12 September 2022 is available at the following link:

https://docs.cfbenchmarks.com/Deloitte_CF%20Benchmarks%20SOC1%20Audit%20Report.pdf

This further verification of CF Benchmarks’ compliance with the UK BMR places the CME CF Bitcoin Reference Rate – New York Variant on the same level of scrutiny applied to widely used traditional financial benchmarks like ICE SWAP, SONIA and RONIA.

Assessing BRRNY values and input data for signs of manipulation

Whilst the BRRNY was designed and is administered to the highest standards, including efforts to uphold provisions of the UK BMR, the proof of the pudding is in the eating and further analysis of the data is required to evaluate its efficacy against the three Rs.

Were there to be a lack of integrity in the input data that could in turn affect the integrity of the benchmark, one would expect to see one of a number of phenomena reflected in the input data provided by Constituent Exchanges. One potential example would be significant price dislocations between Constituent Exchanges.

How well correlated are Constituent Exchange prices?

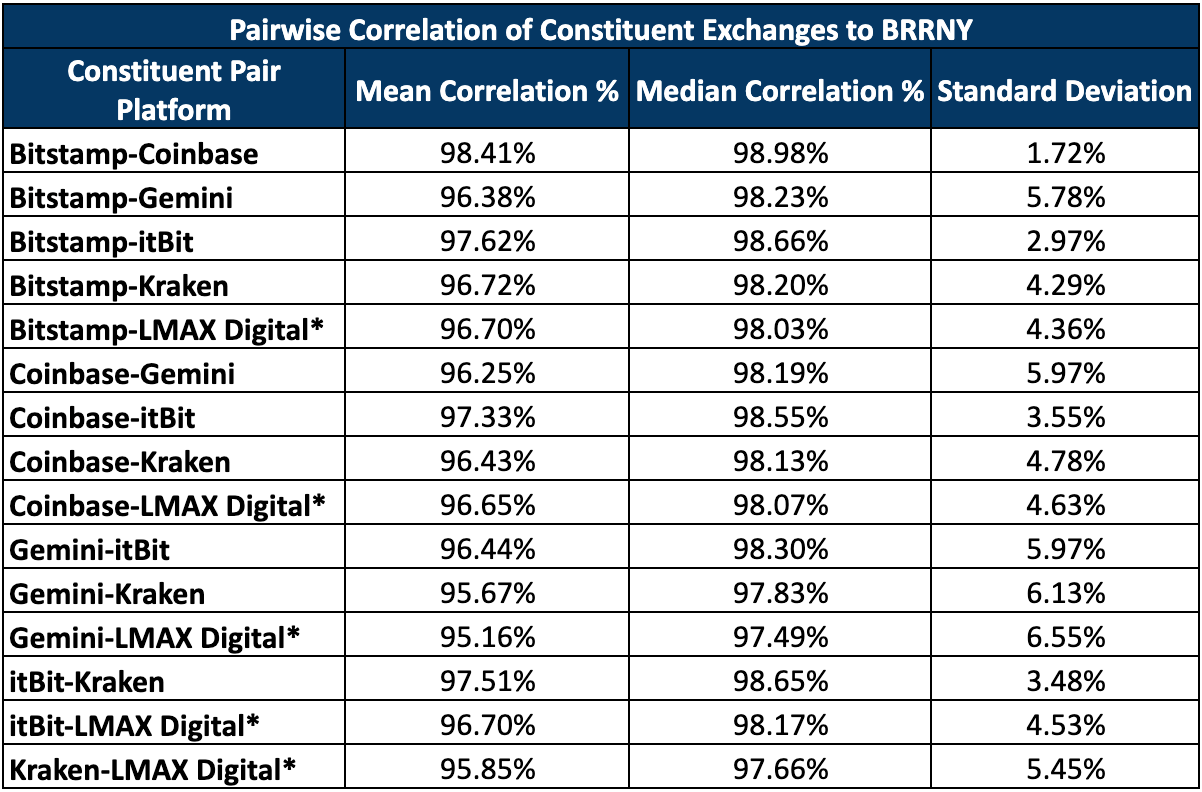

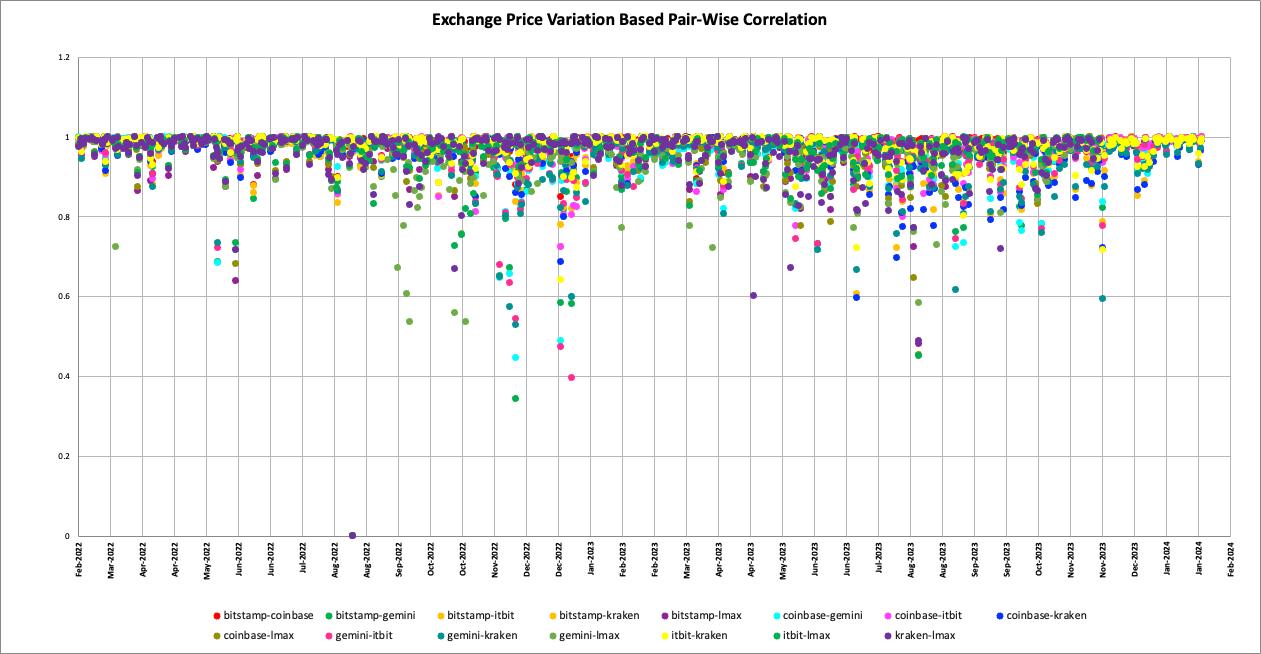

An analysis was undertaken of the pair-wise correlation of prices from Constituent Exchanges on a per-minute basis (the price difference between transactions for each minute at each exchange) during the observation period. The results of this analysis are shown in Table 3.

*LMAX Digital became a constituent exchange from 03 May 2022. LMAX Digital was added as a Constituent Exchange from May 2022.

To illustrate the data analysed in Table 3 in graphical form, Figure 2 (below) displays the full data set. The clustering towards correlation coefficients of 1.00 and the fact that on less than 0.4% of days any exchange had a correlation with another exchange below 0.5 demonstrate strong price correlation between the Constituent Exchanges and points towards fair and orderly markets. The pattern is understandably broken around the time of the FTX bankruptcy (November-December 2022) given the extreme volatility this event precipitated.

Replicability and Implementation

The final characteristic of the BRRNY that this paper will examine with respect to its merits as a benchmark price is its replicability. In other words, that the BRRNY benchmark price can be transacted in practice on any given day without undue risks.

Buying and selling large amounts of Bitcoins at BRRNY

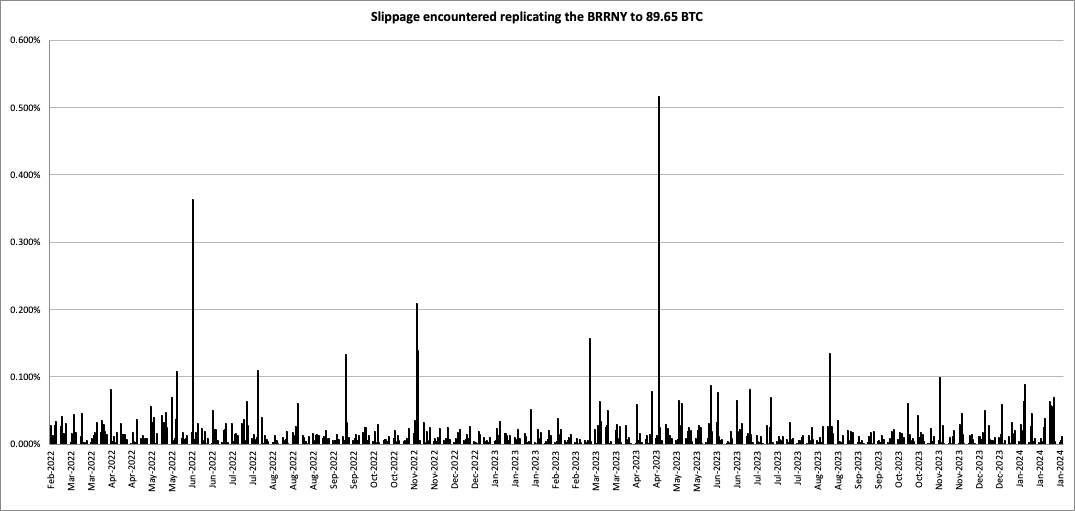

To begin demonstrating the replicability—or to use another term, the achievability—of the strategy presented in this paper for purchasing Bitcoin ‘at scale’, observations taken whilst modelling the purchase or sale of a notional large amount of Bitcoin are presented below. It was decided that the purchase or sale of 89.65 Bitcoins (c. $4.6M at the time of writing) was at an adequate scale to represent a large Bitcoin trade of the kind that institutional traders might need to undertake for a client, or that an issuer of a financial product (such as an ETF or a derivative) would be required to execute on any given day, in order to facilitate trading of that product. A simple replication simulation was thereby conducted to demonstrate the extent of slippage that implementation of the BRR would probably encounter. Given that the purpose is to demonstrate institutionally sized liquidity, the simulation was conducted for weekdays only.

Simulation Methodology

- Trades are executed on n (6) Constituent Exchanges, during a 3,600-second window

- One trade is executed every second and the price achieved is assumed to be the last execution price observed in that second. Its associated volume is assumed to be the volume executed during that second

- If no trade is completed in any single-second period, then the price achieved is assumed to be the price achieved in the previous second, but the associated volume from the previous second is not added to the volume executed in the latest second

It is worth noting that in the ‘real world’, institutions deploy algorithmic systems to execute large-scale asset purchases. It is highly probable that conducting the exercise presented here by means of algorithmic systems would have produced outcomes that are even more favourable. For research purposes, a simplified simulation methodology was favoured to demonstrate the replicability properties of the BRRNY.

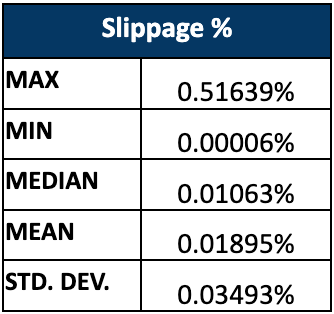

The results of this exercise are displayed in Figure 3 and summary data provided in Table 4. As can be seen, the BRRNY can be replicated with a high degree of confidence and usually with slippage of no more than 1 basis point. On only 6.76% of days would slippage have been greater than 5 bps. Indeed, even on the most volatile day, slippage was only 51.6 basis points. Furthermore, in the 24-month period under observation slippage would have been in double-digit basis points only 10 times.

Conclusion

From the analysis conducted it is quite clear that the CME CF Bitcoin Reference Rate – New York Variant exhibits all the key properties required of a benchmark.

Representative: Bitcoin-USD markets that are operated by the CME CF Constituent Exchanges during 15:00 to 16:00 New York Time are liquid, with sufficient volume of trading to represent the market in a robust manner.

Resistant to Manipulation: The BRRNY Constituent Exchange Criteria ensure that it takes input data only from cryptocurrency exchanges that exhibit fair and orderly behaviour, where trading shows strong price correlations between each other. On top of this, the methodology the BRRNY employs nullifies the effects of any manipulation, and the Administrator’s policies and processes regarding surveillance ensure that any manipulation is detected.

Replicable: The BRRNY methodology promotes replicability, allowing users (especially APs to ETFs) to replicate the benchmark simply and without undue risks, in turn giving them the confidence to provide secondary market liquidity to the ETF shares.

For similar versions of this paper that analyse the CME CF Bitcoin Reference Rate (BRR) and CME CF Bitcoin Reference Rate Asia Pacific Variant (BRRAP), please click the links below:

BRR

BRRAP

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks

CF Benchmarks

Ken Odeluga