Jul 02, 2023

CF Benchmarks Newsletter - Issue 56

Sharing

Here at CF Benchmarks, as well as pursuing our main mission of furthering the development of the cryptocurrency asset class and its continued adoption by provision of our high integrity indices, we’ve also inadvertently, taken on a side quest, of late: conveying the basics of the process of getting a U.S. exchange traded fund to market, from filing to, hopefully, first day of trade.

More to the point, what the specific minutiae of securities regulations pertaining to a U.S.-listed spot cryptocurrency fund are most likely to look. It’s an ascribed role that we’re very familiar with. As CF Benchmarks CEO Sui Chung, noted in a press interview:

“CF Benchmarks has been involved in more bitcoin ETF filings than any other company in the world. Of the 13 filings I think there have ever been, seven have used a CF Benchmarks index.”

Valuable experience to have, valuable experience to share, particularly amid what appears to be a veritable outbreak of ‘sharing’.

The subject of ‘surveillance sharing’ has shot sharply into focus following the filing by BlackRock’s iShares to list, iShares Bitcoin Trust, which, if the application is successful, would be the first U.S.-listed spot Bitcoin ETF. Its net asset value would be calculated from our CME CF Bitcoin Reference Rate – New York Variant (BRRNY), the U.S. market closing time synchronized version of the BRR, known as the most liquid institutional Bitcoin price. (Scroll down to read an overview of our new white paper on the BRRNY below).

The concept of ‘surveillance sharing’ appears to have largely been coined by the U.S. Securities and Exchange Commission, specifically relating to listed exchange traded funds that would invest in digital assets. It trails the commission’s repeatedly expressed contention, in comments accompanying rejections of spot Bitcoin ETF filings over the years, that the cryptocurrency markets face a far higher incidence of fraud and manipulation than traditional markets.

Therefore, that a higher threshold of regulatory look-through is required for such funds than those investing in traditional assets. Hence surveillance sharing: the stipulation that all counterparties - including the stock exchange on which the ETF itself is listed, and the crypto exchanges on which the digital asset is traded - ensure that a systematic network of visibility exists between themselves. Naturally, this network needs to be amenable to regulatory scrutiny at any time.

It’s worth understanding that the prerequisite of surveillance sharing has not emerged as a clear edict or set of instructions, nor even as informal guidance from the SEC. Rather, it seems to be an example of the tacit, iterative, de facto rule-making around cryptoassets, that the SEC has purportedly engaged in, and that market participants have often expressed misgivings about. That’s not our concern here.

As Sui Chung also noted in that interview, the exchange proposing to list iShares Bitcoin Trust, Nasdaq, detailed such an SSA in the ‘Proposed Rule Change’ document, also known as a form 19b-4, that was filed to the SEC in the normal way.

(Likewise, requests to applicants from the commission for further information, of the kind that emerged late last week, are also in the normal course of things.)

The realisation that an SSA will be vital for the success of such filings is spreading. Note the growing number of amendments—and reported intentions to amend—pending spot Bitcoin ETF applications. These include filings posted by Ark Invest/21 Shares and Van Eck. The substance of the amendments have focused on the inclusion of SSAs.

Surveillance track record

Still, ‘surveillance sharing’ as a broad notion is one CF Benchmarks has acquired an unmatchable track record of expertise in:

Note, the longstanding governance procedures of our regulated benchmark indices, requiring routine surveillance of the CME CF Constituent Exchanges that contribute to our pricing sources as a regulatory imperative.

Not to mention proprietary relationships with Constituent Exchanges as a matter of course.

So, whilst it's clear that the first U.S.-listed spot Bitcoin ETF will include a Surveillance Sharing Agreement (SSA), that fund is also likely to be one that includes a regulated CF Benchmarks index as its NAV-calculation price.

Read The Block’s article ‘The multi-billion dollar question posed by BlackRock's bitcoin ETF move’ with an interview of CFB CEO Sui Chung.

Markets: That $30k ‘ETF marker’

Digital assets have received a widely recognized shot in the arm from the entrance of the ‘biggest beast of them all’ into the running for the first U.S. spot Bitcoin ETF.

However, technical analysts will recognise that Bitcoin, effectively a bellwether of the asset class, is in ambiguous shape. Daily intervals chart of our CME CF Bitcoin Real Time Index below, depict a week when prices staged another attempt to hurdle $30k-$31k - initially established as resistance in April - followed by another failure to push through.

By natural probability, repeated failures to breach the threshold increase the chances of prices markedly receding. If so they could potentially drop out of the lower bound of a range that pivots on prior resistance near $25k, before BTC broke higher in February, and which has been subsequently confirmed as approximate support, most recently last month.

Open Interest revives as institutions circle BTC

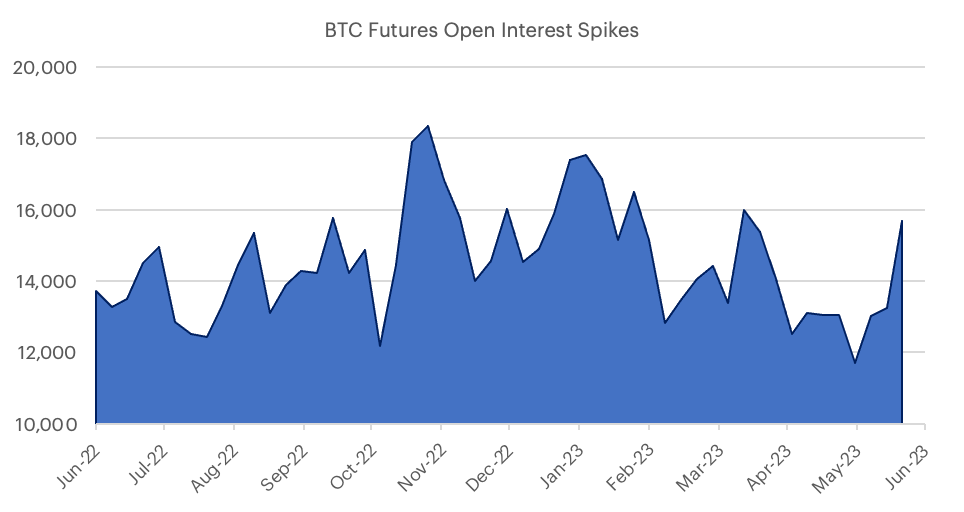

Recent filings from leading asset managers for a spot bitcoin product have reengaged investor interest in the world's largest cryptocurrency. The Chicago Mercantile Exchange (CME) is the premier derivatives exchange that provides efficient exposure to Bitcoin prices through our robust CME CF Bitcoin Reference Rate (BRR). As highlighted below, open interest for CME Bitcoin Futures has risen by almost 20%, reaching just over 15.6K contracts in the week following the recent spot BTC fund filings. Each contract represents 5 bitcoins, bringing the notional value of cash-settled derivatives to almost 80,000 bitcoins. These futures contracts provide large institutional investors with an effective and scalable solution for investing in Bitcoin.

Gabe Selby

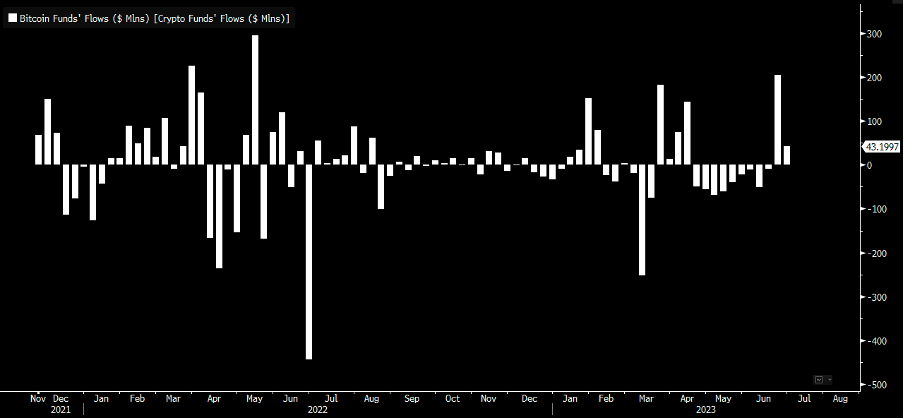

BTC fund flows approach annual highs

On the retail side, existing Bitcoin funds have also experienced a surge in demand. According to fund flow data from Bloomberg, Bitcoin funds have attracted over $250 million in inflows over the past two weeks, reaching levels last seen in early May 2022. Investors must consider that the possibility of an approved spot Bitcoin fund product has already had a sizable impact on the technical factors of this market, which suggests that future implications could also be quite significant.

Gabe Selby

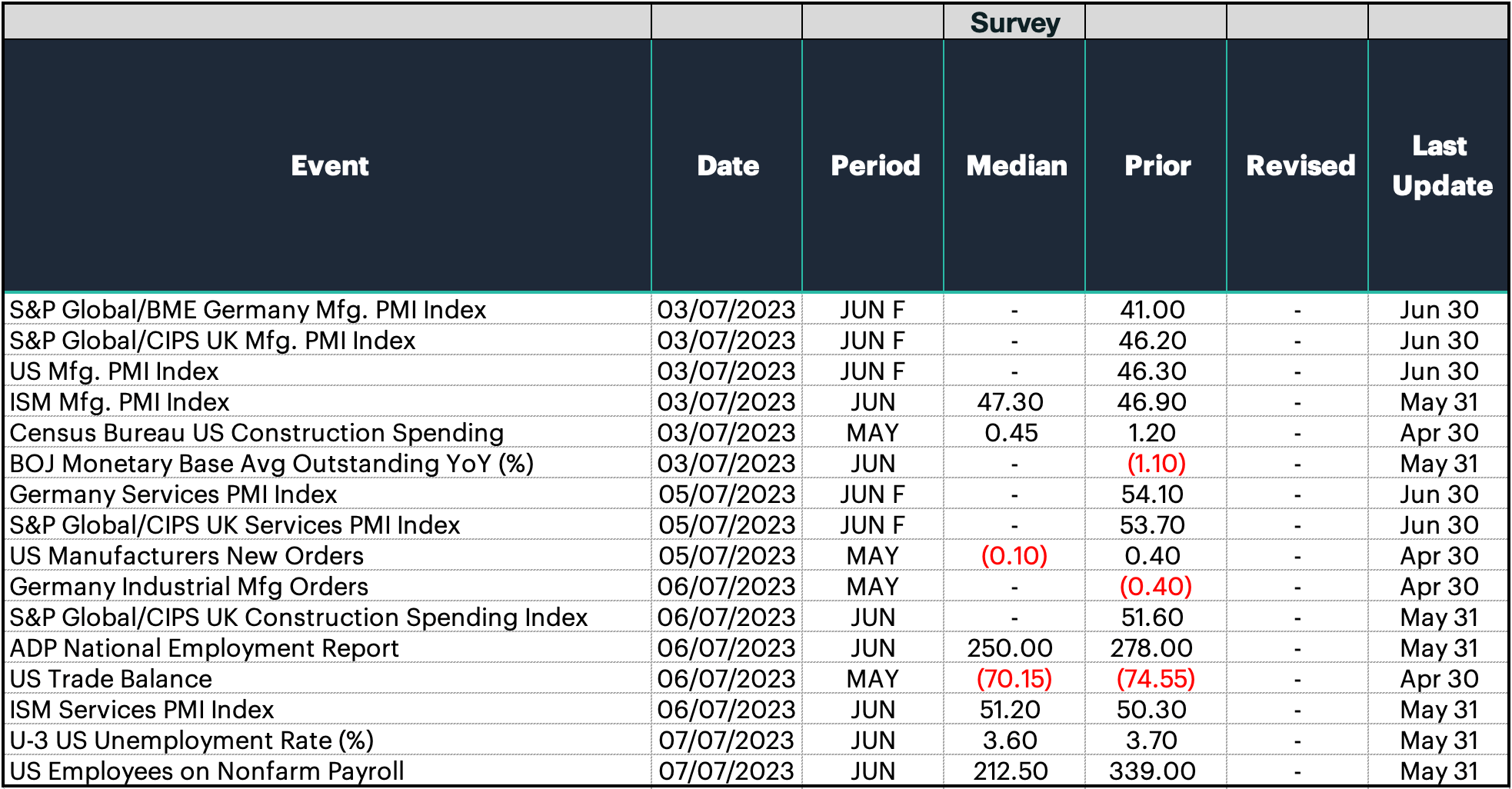

Macro Outlook

Market participants will pay close attention to the latest U.S. non-farm payrolls report in the week ahead. Investors anticipate a slight moderation in job creation, with official figures expected to be just above 200K for the month of June. This latest round of job creation is expected to leave the unemployment rate mostly unchanged. The strength of the labor market has been a significant concern for the Fed's fight against inflation, as sustained upside surprises in job growth may continue to hinder progress in controlling inflation through ongoing wage pressures.

Therefore, a stronger-than-anticipated number may add more credence to the idea of additional rate hikes in the near-term. In other segments of the economy, manufacturing purchasing managers' surveys across the globe will be refreshed. These are expected to indicate that cyclically sensitive sectors remain in contraction, and noticeably weaker than service sectors.

Gabe Selby

Featured benchmark: CME CF Bitcoin Reference Rate – New York Variant (BRRNY)

BRRNY and BRR: identical standards, different reference times

The CME CF Bitcoin Reference Rate (BRR) is axiomatically the most liquid institutional cryptocurrency price in existence, largely because of the hundreds of billions of dollars’ worth of regulated CME derivatives transacted at BRR since inception of the first Bitcoin Futures contracts in December 2017.

However, the BRR’s integration within CME Group’s suite of Bitcoin derivatives is just one part of a growing liquidity complex fomented by the BRR.

Managers of exchange traded products like Evolve ETFs’ Canadian-listed spot Bitcoin ETF and WisdomTree’s EU listed, physically backed Bitcoin ETP, both of which reference the regulated benchmark, have been joined by providers of crypto liquidity products like B2C2's, which utilizes the BRR as a reference price for NDFs, and DRW’s digital assets division Cumberland, that uses the BRR to value and settle OTC derivative contracts.

It follows that this broadening scope of how the BRR is deployed, has grown hand in hand with a need for increased flexibility with regards to when institutions would like to deploy the price methodology that underpins the BTC benchmark.

It's this rising need for a high integrity, replicable, manipulation-resistant and representative Bitcoin benchmark that synchronizes with the U.S. market close that drove the creation of the CME CF Bitcoin Reference Rate – New York Variant (BRRNY).

Indeed, the only difference between the BRR and BRRNY is that the BRRNY references the price of Bitcoin at the closing time of U.S. markets, 16:00 New York Time, instead of the price of Bitcoin at 16:00 London Time that the BRR references.

The BRRNY’s regulated benchmark methodology is identical to BRR's, including the same manipulation impedance measures, like strictly vetted, continuously surveilled and frequently reviewed Constituent Exchanges, the use of volume weighted medians, and others.

Confidence in the BRR’s U.S. variant is already evident from the list of investment firms proposing to strike net asset value of their proposed ETFs against BRRNY: so far these include BlackRock, WisdomTree and Valkyrie.

Still, to show that the BRRNY is empirically possessed of the same qualities as the BRR, we subjected the BRRNY to the same analyses we've subjected the BRR to over the years.

Our newest research paper, Suitability Analysis of the CME CF Bitcoin Reference Rate - New York Variant as a Basis for Regulated Financial Products, is the result.

The new BRRNY report includes, among other analyses:

- An analysis of the BRRNY's volume weighted median deviation per exchange. This would expose possible manipulation if any Constituent Exchange breached a certain percentage. (Spoiler alert: no exchange did)

- A pair-wise correlation of individual exchange prices with prices from each other: there was a vanishingly small number of correlation coefficients below 0.5

- A study of price slippage whilst buying and selling bitcoins at scale; max slippage: approx. 0.12%; standard deviation: 0.015%

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Weekly Index Highlights, December 22, 2025

Crypto's year-end tape remained selective last week, with BTC up 0.9%, while other high-beta majors slipped. The Infrastructure Sub-Category was a major loser in our CF DACS taxonomy, -10.4%, while implied volatility firmed as realized cooled; and our USDT funding rate measure reset above 10%.

CF Benchmarks

Expansion of the CME CF Cryptocurrency Pricing Products Family to include Hedera, Bittensor and Aptos Reference Rates and Real-Time indices

The Administrator announces the addition of Hedera, Bittensor and Aptos Reference Rates and Real-Time indices to the CME CF Cryptocurrency Pricing Products Family.

CF Benchmarks

Cessation of Hedera and Aptos Settlement Prices and Spot Rates within the CF Cryptocurrency Index Family

The Administrator announces the cessation of Hedera and Aptos Settlement Prices and Spot Rates within the CF Cryptocurrency Index Family

CF Benchmarks