Jan 16, 2025

CF Benchmarks Newsletter - Issue 75

- Fast, quick, quick, slow? SEC reviews New Wave of crypto ETF filings

- Not so random: CF Benchmarks' Factor Model for digital assets

- Ethereum Staking demystified: Our Risk and Reward Framework

Skepticism

To understand a key aspect of the crypto price conundrum right now, consider this clip from the CFB Talks Digital Assets podcast posted on X, featuring CF Benchmarks’ Head of Research Gabe Selby, CFA.

He’s detailing how anticipation of fresh monetary debasement could follow its historically observed pattern, and provide a tailwind at the margin for BTC (and by extension, possibly other digital assets).

What happens when bond vigilantes flex their muscles?

— CF Benchmarks (@CFBenchmarks) January 9, 2025

CFB’s Gabe Selby breaks down how debt monetization and potential debasement risks could put pressure on inflation and other macroeconomic factors - and why he believes, “The Bitcoin train is going to continue.”

But what… pic.twitter.com/ElddqmB37n

Forecasts of a recurrence of the pattern seemed cogent after an apparent pivot to a more accommodative monetary regime in September after the first Fed rate cut in four years.

Indeed, Bitcoin’s seminal breach of $100k was, arguably, partially fuelled by participants reconverging around this rationale.

Testing times

December’s policy plot twist – the Fed signing off on 2024, with a 'hawkish cut' – has dented, if not entirely erased, that narrative. Front-month CME Bitcoin Futures settling to our CME CF Bitcoin Reference Rate (BRR) have tested below $90k, for the first time since mid-November in recent days, from as high as $108k, ahead of the holidays.

With the FOMC’s median inflation expectation raised to 2.5% in 2025, vs. 2.1% previously, and a barely changed macro and labor outlook; all partly corroborated by last week’s firm December payrolls report, skepticism that the Fed will follow through on further cuts is becoming entrenched.

This is despite Fed chair Powell’s qualifications in December that policy has now become "significantly less restrictive" and "significantly closer to neutral".

CME Group’s Fed funds futures-based FedWatch now shows an overwhelming expectation that rates won’t change at the bank’s January 29th meeting. The data site has latterly been predicting only 30 basis points of easing throughout 2025, with no move expected before September. Just weeks ago, rates markets were projecting a 25bp cut by June.

One inflation data point is well short of the proverbial spring, though risk assets like stocks and Bitcoin rallied in response. CME BTC, reflecting bitcoin's higher short-term delta to ‘risk’, even had a momentary look just above $100k. 10-year Treasury yields dipped 13 bp.

Trump Factor

And then there’s the incoming Trump 2.0 regime. His comment earlier in the month that “interest rates are far too high,” was unsurprising; simply because it was consistent with everything else emerging from the camp about their fiscal approach and stance on monetary policy. The risk of a conflict between the executive and the Fed seems material, with likely additional consequences for market perceptions, that can feed through to prices.

Prudent optimism

Meanwhile, benign macro forecasts are not even close to being falsified, including from the perspective of the Fed’s own forecasts. Here's an excerpt from our research team’s Market Outlook 2025, published after the Fed’s December policy update.

So, where does that leave us? 2025's economic narrative balances optimism with prudence. While revived business confidence may fuel certain sectors, overall growth likely remains anchored near its longer-term potential. The interplay between Federal Reserve policy, consumer behavior, and business investment will shape the year's economic trajectory, suggesting investors should maintain modest growth expectations while seeking secular opportunities in disruptive technology. (From 'Growth Outlook', page 6.)

Scroll down to read more excerpts from the Market Outlook 2025 report, or click here to download your copy now.

So, we’re back to where we were for much of last year; looking at market inputs that are contradictory, multivalent and in flux. Quite like the macro picture.

Though somewhat superseded, data a few days ago showed broader BTC options market open interest concentrated in $120,000 calls for post January expiry, suggesting underlying crypto sentiment remains resilient.

As CF Benchmarks’ Head of Product Thomas Erdösi comments in the article linked above:

"We could potentially see a change in market fortunes by the end of this month. The inauguration of President Trump on Jan. 20, heralding an increased likelihood of a much more favorable regulatory environment for crypto, could be a key driver in crypto market sentiment".

Indeed, that's the most closely followed watchpoint in the crypto space for the medium term: a potential regulatory transition. And if it happens, its pace of execution.

Scroll on...

- Below we lay out recent commentary elaborating the scope of the regulatory reset ETF issuers seem to be expecting. And we voice a few cautions

- With the year just weeks old, we also re-spotlight high probability secular digital asset themes unearthed by our research team in their seminal Market Outlook 2025

- Supplementing the report, don’t forget our deep-dive podcast surfacing insights from Outlook 2025 in conversational form. Read the episode summary below, then click through to the show

- A summary of our latest podcast can also be found below. It's a final tally of crypto’s seismic 2024, and observations on how crucial regulatory, monetary and macro pieces are shaping up right now

- Meanwhile, as CF Benchmarks continues its mission to accelerate crypto adoption by providing institutional-grade measures of the digital asset class, we showcase two recent research publications by our Product team.

- One establishes the first comprehensive framework for institutional participation in staking rewards

- Another debunks assumptions about crypto’s random walk, isolating several factors exhibiting significant risk premia, thereby creating the first quantitative factor model for the digital asset class, no less

Markets

Below, we republish excerpts from the CF Benchmarks Market Outlook 2025, by Head of Research, Gabriel Selby, CFA, and Research Analyst, Mark Pilipczuk.

Published after the Federal Reserve's policy decision and statement in December, the report remains a current assessment of the macro, on-chain and market trends broadly influencing digital asset prices. More importantly, it provides the most informed forecast available of salient themes all crypto participants need to be aware of over the course of 2025.

Growth Outlook

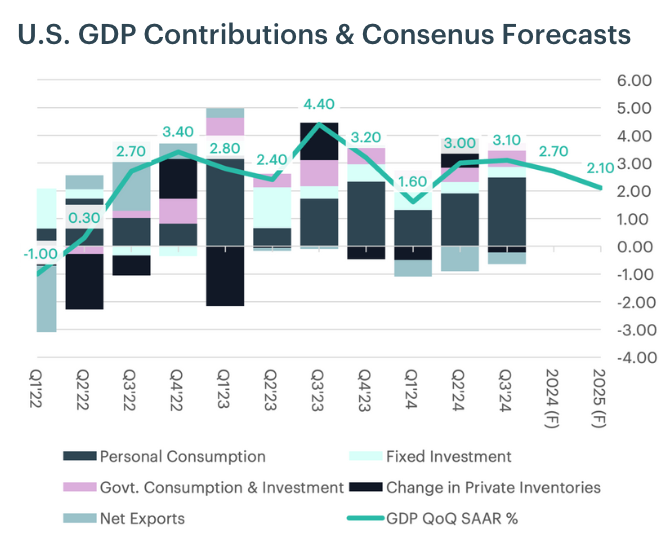

The global economy maintains moderate growth heading into 2025, marked by stark regional disparities. While U.S. markets digest election results and anticipated Federal Reserve policy shifts, mounting pressures from China's property sector crisis, political turbulence in Europe, and persistent inflation in developing economies heighten global uncertainty.

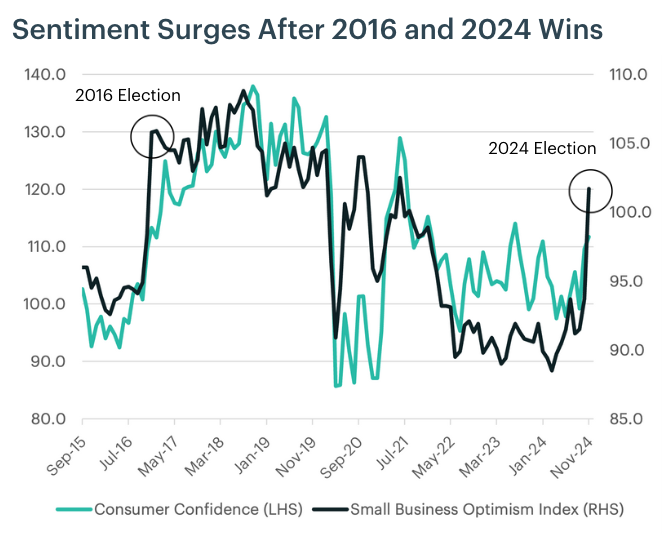

Can Animal Spirits Awaken Economic Dynamism?

The U.S. economy is set to begin the new year with measured optimism following Donald Trump's return to the presidency. While markets and businesses respond favorably to expectations of deregulation and potential tax cut extensions, questions linger about the sustainability of this sentiment and the true drivers of growth. The economy is projected to maintain a modest growth rate through mid-2025—a pace that aligns with potential but falls short of exceptional. This expansion rests primarily on two pillars: sustained consumer spending and recovering business investment. Affluent households, whose spending patterns closely track market performance, remain critical to maintaining aggregate demand as equity markets show renewed strength.

Keynes' famous "animal spirits" are alive and kicking, as the small business sector exhibits renewed confidence post-election. Companies are positioning themselves for future opportunities despite ongoing uncertainties around trade policy and broader economic conditions. However, the potential persistence of restrictive monetary policy may pose a significant challenge to this optimistic outlook.

So, where does that leave us? 2025's economic narrative balances optimism with prudence. While revived business confidence may fuel certain sectors, overall growth likely remains anchored near its longer-term potential. The interplay between Federal Reserve policy, consumer behavior, and business investment will shape the year's economic trajectory, suggesting investors should maintain modest growth expectations while seeking secular opportunities in disruptive technology.

CFB Talks Digital Assets Episode 34: Bond Vigilantes, AI Agents and The Stablecoin Takeover - CFB 2025 Outlook Special

This episode is the perfect companion for exploration of our 2025 Market Outlook Report

Join Head of Research Gabe Selby, CFA, and Research Analyst Mark Pilipczuk, as they unpack the highlights with Head of Content, Ken Odeluga.

- Get our analysts’ reaction to the Fed’s ‘hawkish pivot’ last week, which upended policy expectations and triggered a big volatility spike. But how much has the rate outlook really changed? And what are the implications for markets?

- The Bond Vigilantes are back! How will the Fed react as these influential participants flex their muscles?

- As for crypto in 2025 - we’re set for another exciting year. Listen in as our research team breaks out the highest-probability themes:

- The next adoption inflection point, as blockchain transactions per second start outpacing legacy infrastructure speeds

- Why RIAs are set to become the dominant holders of crypto ETFs

- How TradFi-crypto convergence could be fuelled by a 50% surge in stablecoin growth to $300 billion by end 2025

- Meet your Crypto AI Agent

- The Regulatory Reset - key bills to watch in 2025: The Bitcoin Act, FIT21, Loomis - Gillibrand, and others

Spotify

Apple Podcasts

YouTube (audio only)

Amazon Music

Featured utility: CF Benchmarks Factor Model for Digital Assets

CF Benchmarks introduces first Institutional-grade Factor Model for Digital Assets

Debunking the myth of crypto’s Random Walk: our quantitative research shows liquid market returns mirror traditional market dynamics

Institutions eye Crypto Factors

Surveys over the past decade have shown that the use of factor-based strategies by institutional investors in their investment processes is widespread and continuing to grow.

The trend is prevalent across the two broad traditional market asset classes of equity and fixed income, with evidence of increasing interest in factor-based credit strategies also readily available.

This represents a remarkable proliferation of factor-based strategies, considering that widespread adoption of quantitative factors as part of the portfolio management process is known to be directly linked to the relatively recent publication of key research in the field; chiefly the Fama-French Three-Factor Model in the early 1990s.

The extensive and increasing utilization of factors by institutions managing traditional assets suggests this investor cohort will seek to deploy factor-based strategies for the management of digital assets as well, particularly given the significant adoption of crypto by major financial firms seen in recent years.

The Challenge of Validation

That said, attempts to do so are unlikely to be free of friction. The substantial discontinuity between the characteristics of traditional asset classes and those of the digital asset class mean that factor strategies applicable to the former cannot simply be copied and pasted on to portfolio management systems for the latter.

It’s likely that even relatively large traditional institutions simply do not possess the installed base of expertise required to undertake the breadth of research necessary for potential validation of factors embedded in the digital asset class.

Meanwhile, the relatively narrow range of reliable crypto market datasets available is another challenge.

Nevertheless, it is axiomatic that the same broad benefits of factor-based strategies, evident in their use with mainstream assets, are certain to be engendered if such approaches were to be utilized within crypto.

These include the delivery of long-term risk premia, reduced overall portfolio risk, increased transparency during portfolio construction and management, and improved understanding of past and future drivers of returns.

It is for this reason that CF Benchmarks, the registered Benchmark Administrator and world’s largest provider of regulated crypto pricing sources, by assets under reference, has conducted the most extensive quantitative analysis of validated crypto data sources for the investigation of factors applicable to the digital asset class.

Continue reading the launch article here.

Introducing CF Benchmarks’ Risk and Reward Framework for Ethereum Staking Returns

Finally, an institutional-grade analysis of Ethereum staking risks and rewards

CF Benchmarks, the leading cryptocurrency Benchmark Administrator, is excited to present the first comprehensive, public framework, for institutional quantification and participation in Ethereum staking rewards.

It's in the form of a research paper, produced by the CF Benchmarks Product team:

Understanding the Dynamics of Ethereum Staking Returns: Risk and Reward Framework

Critical timing

This report coincides with a critical juncture for the Ethereum network.

The listing of the first U.S. spot Ether ETFs in July was a major inflection point for adoption, enabling large institutions to gain exposure to the asset’s price for the first time.

U.S. Ether ETF vehicles are not currently permitted to stake ETH. Nevertheless, institutional participation in Ethereum staking, in a number of forms, has clearly been on the rise for some time.

The growth of staking

ETH deposited on the Beacon Chain - the Ethereum 2.0 component that enabled the network to transition to a Proof of Stake (PoS) consensus mechanism from Proof of Work (PoW) - has increased by approximately 5.7 million ETH this year, after almost doubling in 2023.

At the time of writing, around 29% of total ETH supply is staked, with a dollar value of at least $115 billion, easily the highest for any PoS blockchain.

Meanwhile, the number of validator nodes, Ethereum’s critical network function for block proposal, voting, and transaction verification, has risen from less than 450,00 in January 2023, to more than 1 million currently.

The proliferation of staking protocols in recent years complicates assessments of the institutional proportion of that growth. Still, the most popular protocol, Lido’s stETH, which accounts for some 28% of total staked ETH, grew 5% year-on-year to late October 2024, following its 93% surge in 2023.

Moreover, a survey of “institutional token holders”, published in October 2024, by Blockworks Research, showed 69.2% were staking Ethereum. Blockworks Research noted 78.8% of respondents were investment firms or asset managers.

Asymmetric awareness

Inevitably though, given the accelerating growth of institutional ETH staking, the distribution of comprehensive, up-to-date, understanding of its granular mechanics, risks, and even key aspects of its fundamental value proposition, are also, almost certainly, increasingly asymmetric.

In order to close this gap in understanding, CF Benchmarks has deployed its proven expertise in defining and quantifying the blockchain economy, towards providing the most thorough and unbiased assessment of the potential rewards and inherent risks involved in Ethereum staking available.

Our proposed framework opens a path to institutional grade risk and liquidity management of Staking rewards and associated products, meaningfully advancing the adoption cycle.

Upon completion of our paper, readers will understand the following critical aspects of Ethereum staking:

- How a mix of random and deterministic rewards creates a complex probabilistic return profile for validators, balancing stable income with variable rewards

- How these parameters make staking rewards dynamic, rather than static, requiring a probabilistic approach to understanding potential returns

- As such, this is why staking rewards are varied and not fixed, due to both systemic factors (chiefly, the number of validators) and market conditions (e.g., tips), creating a complex reward environment that requires careful analysis

- Validators need to consider these fluctuating conditions when developing staking strategies and setting expectations for returns

- We provide insights into how changes in these parameters affect the associated risks and rewards, and interpret these findings through financial metrics, such as return distributions, expected value, and confidence intervals

- Finally, the reader will be afforded a more enlightened comprehension of the staking consensus mechanism: to see it as not just a technical infrastructure, but as a quantifiable financial investment with measurable risks and returns

CFB Talks Digital Assets Episode 35: Market-Making AI Agents and the New Crypto ETF Regime: Welcome to 2025!

Digital assets have a high bar to beat in 2025 after a stonking 2024 - but with a new pro-crypto US administration waiting in the wings, this year promises to be just as consequential.

Markets-wise though, January is off to a less than sure-footed start...

As CF Benchmarks Head of Research Gabe Selby, CFA, and Research Analyst, Mark Pilipczuk point out in our first podcast of 2025, this follows the ’Santa Rally’s no-show in December.

Still, that's after one of the strongest crypto mega cap returns for years. And with alts underperforming overall, catch-up trades could be on the cards.

To learn which ones, and a lot more, join Gabe, Mark, and Head of Content, Ken Odeluga, as they tally up crypto’s seismic 2024, and surface everything to watch going into another critical year.

Top Themes:

- AI agents: With some already earning above the median US wage, find out how they could soon be market-making, operating cross-chain liquidity, and even doing agent-to-agent transactions. What could possibly go wrong!

- Ether flows punched above their weight relative to the ETH/BTC ratio into year-end, but Ether AuM still doesn't reflect ETH's share of that pair’s joint market cap. Does December’s $2B ETH inflow mean the catch-up has begun?

- Regulatory transition: Will we see Solana and XRP ETFs, before we see CFTC-regulated SOL and XRP futures? And which ETF filings have the highest chance of near-term approval?

All in all, it’s time again to grab your preferred beverage, sit down, and soak up the latest insights from our institutional insiders.

Find us on all the platforms below, or wherever you listen.

Listen on Spotify

Listen on Apple Podcasts

Watch on YouTube (Audio)

Amazon Music

Here’s how long we may wait for the new wave of US crypto ETFs

The crypto ETF review process could now run on two tracks as a new regulatory regime begins

The ‘old doctrine’

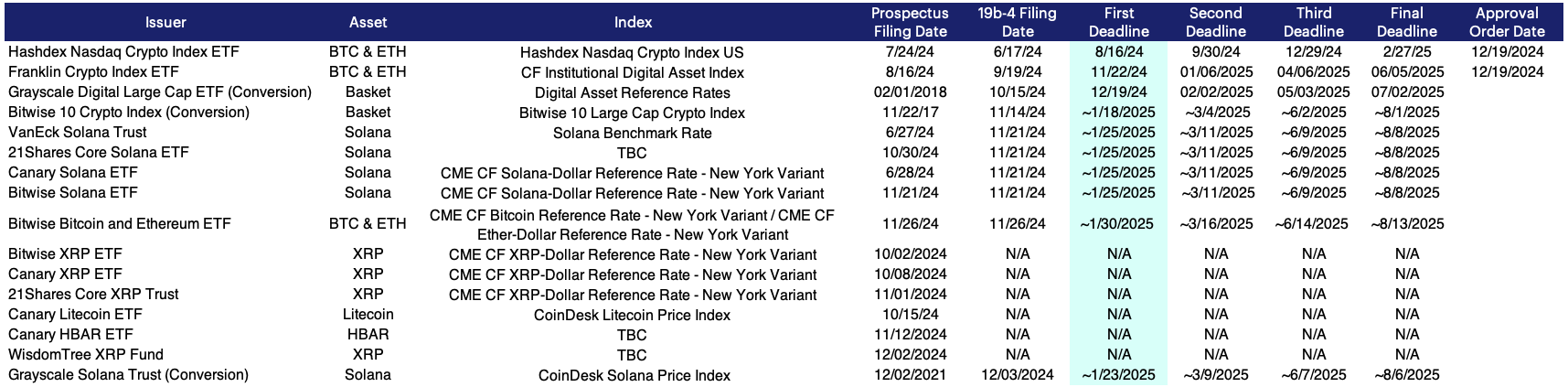

Even before the re-election of Donald Trump as U.S. President, ETF issuers began telegraphing paperwork into the SEC proposing digital asset investment funds with, at the time, what seemed to be only moderate chances of securing regulatory approval.

Back then, these odds were judged against what we can call an unofficial ‘doctrine’, pieced together by investment firms and other participants – including CF Benchmarks – defining assets with the best chances of SEC approval for wrapping into ETFs.

After Trump went on to win, though, several more filings followed, suggesting increasing assurance among issuers.

The list of crypto ETF filings is below, as of mid-December 2024; including two recently approved applications.

(Note 'N/A' indicates no form 19b-4 filed by the proposed listing exchange.)

New Chair

Now, with Gary Gensler set to depart as SEC chair in late January – most likely to be replaced by a known crypto proponent, former commissioner and staffer Paul Atkins – investment firms will almost certainly become even more confident of chances of regulatory approval for a wider array of crypto ETF assets beyond Bitcoin and Ether.

Still, there are quite a few counterbalancing points to consider.

Will the SEC really moderate its previous intractable interpretation of the Securities Act, with regards to crypto, as rapidly as many applicants seem to expect?

Though increasingly justified on the face of it, there’s still a risk the chances are being overestimated.

In this post, we’ll try to weigh how much of an improved probability of approval we should expect for recent crypto ETF filings, once the the upcoming change in the regulator’s leadership takes place.

It ought to go without saying that from this point on, you’re reading speculation, representing the author’s thoughts.

Inferred conditions

First, a reminder of the SEC’s ‘old doctrine’ for spot crypto exchange traded products, which is now widely expected to lapse.

It's important to understand it’s an inferred ‘doctrine’ which emerged mostly due to the bias for implied precedent and official opacity at the SEC under Gensler.

Likewise, this so-called old doctrine forms the basis of an inferred set of eligibility conditions for probable ETF approvability, formulated by various institutional crypto participants.

These conditions have been articulated several times by CF Benchmarks over the years, in numerous ETF applications we’ve assisted clients with.

Importantly, the conditions were in play when the SEC approved both the listing of the spot Bitcoin ETFs in January 2024, and eventually, the listing of spot Ether ETFs, around six months later, implying corroboration.

CF Benchmarks presented its reasoning to the Commission most recently in a Comment Letter submitted on behalf of Ether ETF applicants. The Commission took the unusual step of citing CF Benchmarks’ comments and data in its Ether ETF approval order.

Read on here

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Building Bitcoin Capital Market Assumptions

Bitcoin’s institutional adoption demands robust, pragmatic CMA frameworks that integrate quantitative modeling, macro analysis, and valuation to guide strategic and tactical allocations across market cycles and investment horizons.

Gabriel Selby

Transition of CF EOS-Dollar Indices to CF Vaulta-Dollar Indices

EOS (EOS) benchmarks will transition to the Vaulta (A) designation

CF Benchmarks

Kraken Launches LCAP Perpetual Futures, Expanding Access to Regulated On-Chain Crypto Index Exposure

Kraken has today launched a perpetual futures contract referencing the LCAP DTF, broadening access to one of the market’s most institutionally aligned on-chain crypto portfolios.

Ken Odeluga