Nov 02, 2021

CF Benchmarks Recap - Issue 42

-

ProShares BTC Strategy ETF joins top 10 in trading volume

-

BITO pushes the envelope in more ways than one

-

Australia greenlights crypto ETFs backed by CFB guidelines

BITO opens new crypto era

A fortnight after ProShares’ Bitcoin Strategy ETF (BITO) racked up a series of records, and the more modest debut of Valkyrie’s Bitcoin Strategy ETF (BTF), there are signs that things are just getting started in the nascent ‘alternative’ sub-sector of crypto ETFs (we cover several developments below). But while there are myriad conclusions to be drawn, here are four key ones that we expect to remain relevant, from our perspective as the administrator of the regulated benchmarks that play an integral part:

-

Investors are comfortable with the ETF wrapper as a way to access BTC conveniently and securely

-

Concerns about investor appetite for futures-based crypto ETFs were overdone.

-

The extent that ProShares' track record of ETF management would underpin investor confidence may have been underestimated

-

Our long-standing expectation that approval of a Bitcoin ETF would pivot on end-to-end regulation has been vindicated:

- CFTC oversight of CME BTC Futures, a de facto mandatory component of Bitcoin strategy ETFs

- CME CF Bitcoin Reference Rate benchmark, calculated and administered by UK FCA regulated Benchmark Administrator CF Benchmarks

- CF Benchmarks’ CF Bitcoin-Dollar US Settlement Price as BITO’s Performance Index

We believe these takeaways set the stage for continued institutional support.

When huge demand meets modest position limits

Attesting to the strength of demand, BITO was the fastest ETF to reach $1bn in AuM, with $1.1bn within 2 days, and assets of $1.24bn as of Oct 25. That indicates continued growth, though those figures don’t quite tell the complete story. As of Oct 27, total assets had ballooned to $2.248bn looking at BITO’s daily holdings, but $1.129bn, or 50.25% comprised of “Net Other Assets/Cash” with the remainder in Treasury Bills maturing late-Jan/mid-May 2022. These are of course, the fingerprints of exchange position limits. The CME did recently announce a pre-emptive increase of its BTC Futures limit, per contract, to 4,000 from 2,000 before. That’s applicable from the November front month, with the proviso that max holdings can be no more 2,000 three days before expiration. Barron’s reported that ProShares sensibly applied for a waiver, though the outcome isn’t known, with BITO last week publishing ownership of 572.00 in (now expired) October contracts and 3,233.00 for the current front month, November. Consequently, with second-mover demand for Valkyrie’s BTF naturally more modest than for BITO, complementary effects that could have siphoned off a share of contract volumes, keeping BITO away from position limits, haven’t been as strong as hoped for. Still, these (presumably) short-term uncertainties underscore BITO’s success, whilst CME’s recent doubling of position limits bodes well for another expansion in the near term.

Bitcoin price drama keeps pace with doggie tokens

Crypto’s latest watershed coincided with another bout of range expansion and volatility across capitalisation classes. CME CF Bitcoin Real Time Index’s (https://www.cfbenchmarks.com/indices/BRTI) max value was marked at $66,974.17, in the thick of the BITO launch, timestamp 20/10/2021, 14:52 UTC. ETH followed asynchronously, with its latest records partly tied to froth from ERC-20 token Shiba Inu, finally, flipping Dogecoin…temporarily. CME CF Ether-Dollar Real Time Index (ETHUSD_RTI) recorded $4,458.78, on 29/10/2021 at 16:07 UTC. Both regulated benchmarks then sharply reversed and remain soft: BRTI stood at $60,854.35; ETHUSD_RTI was at $4,287.13 on Monday Nov 1, around 17:45 UTC.

What BTC ETF?

Unsurprisingly, the watershed wasn’t universally celebrated, or even acknowledged across established markets. For instance, whilst mainstream media covered the launch, it was downplayed or even ignored by some institutional publications. A reminder that fast and slow lanes for crypto ‘normalisation’ remain, even after the last fortnight.

BITO joins Top 10 ETFs by volume

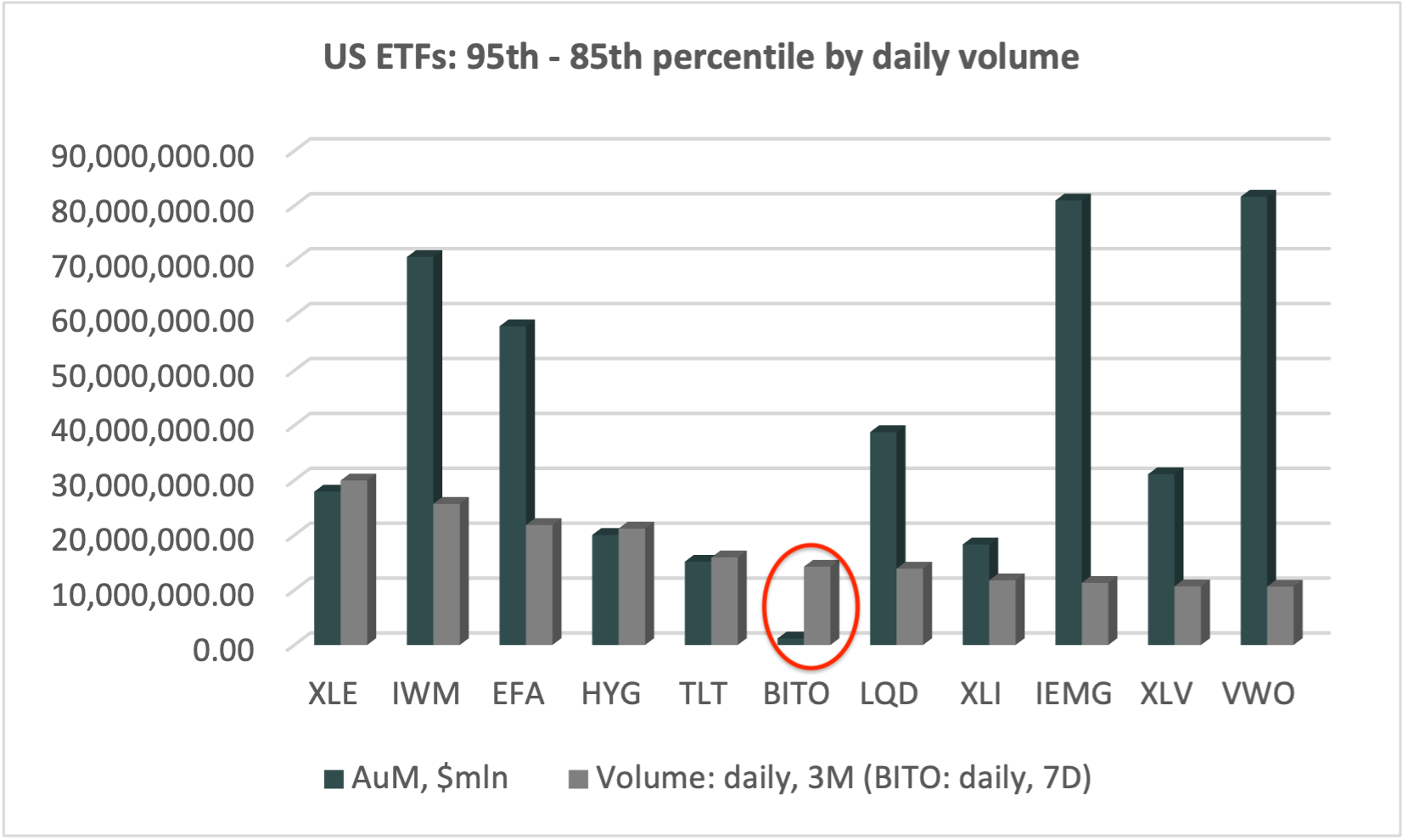

Unfortunately for the crypto-averse, the sheer scale of the market reception suggests that a threshold of demand that can continue to be profitably ignored has passed. Whilst volume comparisons with longer-established ETFs aren’t strictly valid, a snapshot of daily average BITO volumes thus far is still indicative. Seven trading sessions in (Oct 19th through 27th), BITO average daily volumes were akin to those of ETFs within the 95th-85th percentile of highest-volume U.S.-listed ETFs. That pace suggests BITO could eventually reach similar AuM levels to its percentile peers, as illustrated below.

Figure 1 - Trading volume: 95th-85th percentile of U.S. ETFs vs. ProShares Bitcoin Strategy ETF

The point behind relative growth comparisons is an important one to grasp, particularly their historical implications. There are several parallels between BITO, the first U.S.-listed Bitcoin ETF, and SPDR Gold Shares (GLD)—the first U.S.-listed gold ETF—which emerged with a similar level of controversy and rapt market attention as BITO, in 2004. GLD achieved £1bn in AuM in 5 days, whilst BITO did so in 2 days. Like BTC, gold continues to look like it’s here to stay. Meanwhile, GLD is now the largest Gold-related ETF and an unquestionable fixture of the institutional investment sphere, whilst trading volumes at the debut of BTC’s first U.S. ETF also point to the longevity of BITO. Read our take on the ProShares Bitcoin Strategy ETF launch here. • Keep up to date on the latest BITO developments with ProShares’ Bitcoin Strategy ETF homepage.

Now and next: VanEck, Direxion, Valkyrie…Invesco, Aussies

Following the blowout launch of ProShares Bitcoin Strategy ETF, the pace of follow-on news has predictably been rapid. We summarise some of the most salient developments from our perspective below.

- Among the most surprising: Invesco’s sudden cancellation of its Bitcoin strategy ETF, a day before the ProShares fund launched. The decision looks to have been driven by calculation of the impact of BITO’s first-mover advantage. As we’ve seen though, given Valkyrie’s decision to go ahead with its own BTC strategy ETF, Invesco’s decision wasn’t its only choice

- Just as intriguing: multiple delays of VanEck’s Bitcoin Strategy ETF (ticker: XBTF) despite the group saying it would launch “as soon as practicable.” Initially slated to begin trading soon after ProShares’ fund, in the week beginning Oct 18, two weeks later, XBTF was still MIA. For now, the mystery is still more about ‘when’ rather than ‘if’, after a ‘final’ prospectus was filed just days ago

- Fee trends in new fund sub-sectors are usually lively and typically downwards, with Bitcoin strategy funds no exception. ProShares Bitcoin Strategy ETF’s AER is 0.95%, whilst Valkyrie also published a ‘total expense ratio’ of 0.95% for BTF. VanEck’s XBTF, once launched is expected to have the lowest management fee of the trio at 0.65%, whilst implicit pressure from Canada, where several spot-based BTC ETFs trade, is significantly to the downside. The lower end there is just 40bp. As ever, though potentially uncomfortable for issuers, declining management fees validate the health of investment markets, and consumers are the ultimate beneficiary

- Speaking of the pace at which the BTC strategy fund subsector is developing, at least two issuers are looking to expand the scope of funds available to its logical conclusion, with applications for leveraged and inverse offerings. Strategic ETF veteran Direxion applied to list Direxion Bitcoin Strategy Bear ETF, that would encapsulate short exposure to CME Bitcoin Futures. Direxion has yet to specify a headline leverage ratio, or if indeed the fund will be leveraged at all. Valkyrie has applied to list a very moderately leveraged BTC strategy fund. Questions have quickly arisen about how receptive the SEC might be to leveraged Bitcoin futures funds, reportedly prompting Valkyrie to pull its application. Direxion’s application remains pending

- Though pipped to the post—eventually—by the U.S.’s SEC, Australia’s ASIC has signalled for months that it wants markets there to be in the fast lane when it comes to exchange traded cryptoassets. The Aussie regulator even adopted the essence of CF Benchmarks’ policy guidelines in a consultation paper out earlier in the year. Now, ASIC has given conditional general approval to fund managers looking to list crypto ETFs. Permissions currently appear to cover only prospective Ethereum and Bitcoin funds, though ASIC guidance on other assets is expected to follow shortly. Look out for our detailed reaction to ASIC’s green light in coming days.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks

CF Benchmarks