Sep 14, 2020

Crypto Market-Cap Concerns solved - ‘FUD’ not so much

‘FUD’ is unlikely to dent rising crypto interest - so the time for institutions to address their free-float and fungibility worries is still now

This FUD too, will pass

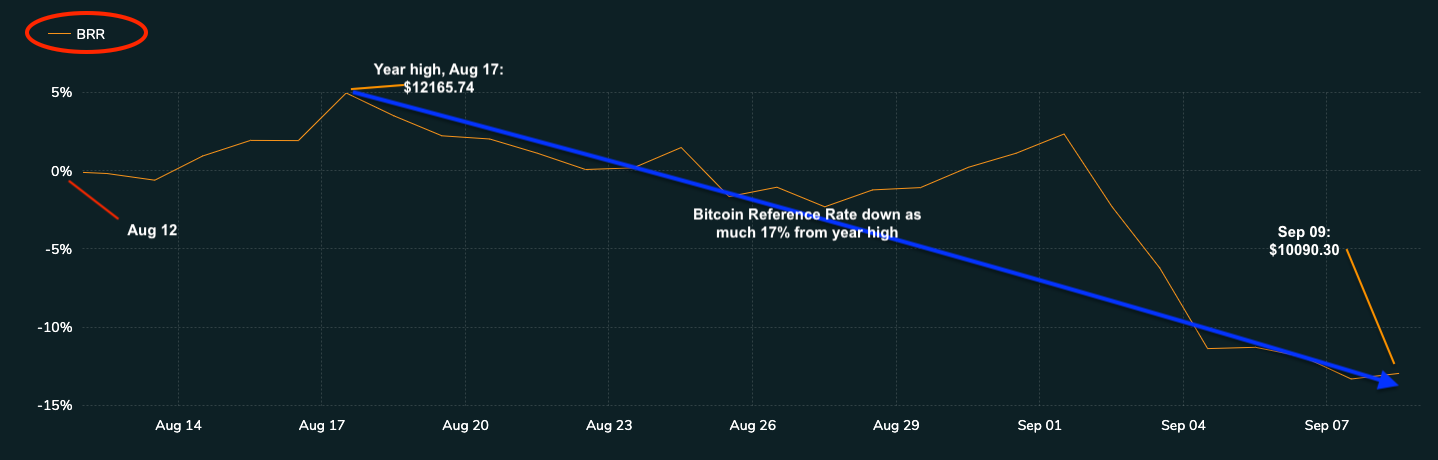

The crypto world, known for an abundance of slang terms, predictably has one for sentiment accompanying price swoons, like the one seen in recent weeks. FUD, or ‘fear uncertainty and doubt’, speaks for itself, after major coins followed Bitcoin’s week-long trend of rapidly handing back months of significant gains. Even after firmer trading in the last few days, the dominant cryptocurrency continues to flirt with the ‘psychological’ $10,000 level, just weeks after reaching a peak for the year above $12,000. At times, the loss from that top exceeded 20%.

Figure 1. Rebased chart: CME CF Bitcoin Reference Rate – 09-09-2020  Source: CF Benchmarks

Source: CF Benchmarks

That’s the crypto markets for you. Traders focusing on this notoriously volatile asset class face far more angst than their mainstream-market counterparts. And during times of enhanced FUD, the beating of chests and gnashing of teeth that typically overflows from social-media and messenger spheres is not particularly limited to the inexperienced.

Still, it tends to be the full extent of the hand wringing. After all, if there’s one thing that participants in this market get used to quickly—it’s volatility. With cryptos infamously hypersensitive to geopolitical and social events, as well as latterly being in highly correlated with equities, buyers learn the hard way to expect the ‘unexpected’. Or they get out. In other words, logic that says the latest pullback will barely dent underlying bullish longer-term crypto sentiment looks compelling.

So, while some asset managers already invested in digital assets may be considering reduced allocations, many—and their clients—will be undaunted. Some will even see an opportunity to buy at discounts that didn’t exist just days ago. Indeed, there’s little evidence that broader dramas of the year have significantly dampened Wall Street’s and Main Street’s growing interest in the digital asset class. Note that a June Fidelity Digital Assets survey of 800 U.S. and European institutional investors showed 6 out of 10 believed digital assets had a place in their investment portfolios, compared with 36% already invested in them. That came just three months after one of the crypto market’s most cataclysmic-seeming (at the time) collapses, when Bitcoin plunged 50% in just one day.

Fungibility times

Regardless of risks then, there’s a sense that when it comes to rising crypto appetite, the genie has simply escaped the bottle and can’t be put back in. For many institutions, it may well be a case of ‘if you can’t beat overwhelming client demand, you might as well join it’. For these, the pragmatic stance would be to address all possible risks with the most optimal solutions possible.

Risks for current and prospective crypto investors are of course numerous—but the hazards are arguably higher for institutions, due to the presence of regulatory, legal and even reputational pitfalls. Some are more subtle and may even straddle several possible negative impacts simultaneously. That’s partly down to the fact that the inherent volatility of the crypto asset class isn’t limited to market price. Unlike for established assets like fiat money or liquid equities, the fungibility of cryptocurrencies can also occasionally be called into question. Essentially, fungibility means the degree to which units of an asset class are abundantly available enough that each unit can be substituted with an identical unit for the same market price. The issue is closely related to the more familiar concept of liquidity. If an asset class lacks liquidity, that can have an impact on its price.

In crypto, reduced liquidity can come about for the same reasons that it can theoretically occur in any asset. For instance, consider a situation in which a company’s shares are purchased and then simply ‘parked’ in the holder’s account for several years. Over that time, those shares are no longer available to be traded on the market. This has reduced the liquidity of the asset, or more precisely, reduced its free float. Well, for established assets like stocks and fiat money, any reduction of circulating supply will typically impact unit price marginally on a day-to-day basis because of their abundant liquidity. Shares and currency notes are typically numbered in the hundreds of millions and often in the billions.

However, cryptocurrencies are a form of money at a very early stage of their evolution, so their circulating supply tends to be lower than that of established assets, with units more often numbering in the millions. Translating the same liquidity scenario above into its crypto version, we need only imagine a major account that’s ‘HODLING’. Or perhaps even an institution obligated to maintain a gigantic holding for operational reasons. When outsize investments or divestments like these occur, they’ve been known to buffet crypto prices significantly. Additionally, there are some crypto-specific factors that can savage liquidity in ways that don’t occur in mainstream assets. Consider the incidence of hard forks, and other governance or blockchain-related policy changes that can radically reduce (or increase) supply overnight.

Replicant hunt

The chief concern for the institutional market segment is that the task of replicating an asset class becomes more difficult following actual or even just perceived liquidity changes. Replication is an obligation that comes into play when a provider offers any investible asset, like one that is based on a market index. If the product is to truly represent for an investor the portion of a market that it purports to, each constituent must be invested in in exactly the same proportions as in the index. However, that obligation can become problematic when there are significant swings in liquidity. And, as indicated earlier, if an investible product may potentially fail to do ‘what it says on the tin’—i.e., honour its terms and conditions—that could be a serious regulatory and legal issue for the provider.

On the other hand, if significant questions around liquidity and fungibility occur frequently, they add to investment risks because of the possibility that they may obligate increased frequency of portfolio allocation changes. Because such moves have attendant costs, they can hurt returns.

All told, fungibility and liquidity are bigger potential challenges for crypto asset managers and providers of investible crypto products, than for those involved in traditional markets. There are therefore additional challenges to deal with when servicing crypto client demand. However, as we’ve seen, the demand trend for digital assets appears to be going only in one direction right now—up.

So, what can service providers and asset managers do? Well perhaps what they shouldn’t do is more instructive – nothing! Doing nothing would be a bad idea whilst client questions about when appropriate crypto offerings will become available are increasing. Instead, the more adroit institutions will acquire the tools needed to pave the way for crypto participation, but with maximum risk control.

As institutions with foresight prepare for crypto adoption to ramp, one of the first most pressing needs they will face will concern replication within investible products. Fortunately, first-mover solutions for those first-mover problems already exist. CF Benchmarks’ crypto indices have been carefully designed to address the very problems outlined above. Having done so, they are now the only crypto indices with regulatory accreditation, as CF Benchmarks was the first and so far, still the only crypto index provider to have received authorisation as a benchmark provider from a regulator in Europe.

Step 1: Ultra Cap 5 Index

Moreover, service providers and asset managers looking for proven representation of the crypto market from which portfolios or exchange traded funds can be constructed now have CF Benchmarks’ Ultra Cap 5 Index, a market capitalisation-weighted portfolio of the top-5 cryptocurrencies. Proven to account for no less than 75% of the entire crypto market, the index brings together all of CF Benchmarks’ methodologies and standards. By definition, it is the only multi-asset benchmark index for the crypto market.Moreover, service providers and asset managers looking for proven representation of the crypto market from which portfolios or exchange traded funds can be constructed now have CF Benchmarks’ Ultra Cap 5 Index, a market capitalisation-weighted portfolio of the top-5 cryptocurrencies. Proven to account for no less than 75% of the entire crypto market, the index brings together all of CF Benchmarks’ methodologies and standards. By definition, it is the only multi-asset benchmark index for the crypto market.

With the Ultra Cap 5, as with all aspects of CF Benchmarks’ index methodology, multiple levels of control are applied to prevent potential fungibility and liquidity vulnerabilities from manifesting as practical impairments. For these reasons, the Ultra Cap 5 Index is likely to become a logical first step for firms looking to open up a store front into the crypto world for clients.

Below, we note the most critical aspects of CF Benchmarks’ methodologies that address fungibility and liquidity issues. A complete set of the measures deployed can be found in the CF Benchmarks Multi Asset Series Ground Rules. There, the section most relevant to this article is ‘4. Constituent Weighting’.

- Total Fungible Supply: the first key refinement deployed was to define total available supply more narrowly for crypto market usage. This is because in digital assets, there are a number of aspects that mean Total Available Supply is not the same as the Total Supply Available to be Exchanged or Spent. Therefore, we have adopted this narrower definition of Total Fungible Supply from which full market capitalisation can be determined

- Then comes the process of establishing Total Supply Likely to be Available for Trading

- The unique advantage of the cryptocurrency asset class is that the entire network can be queried by any participant, so long as they have a computer set up as a node of the blockchain. Then, it is a matter of setting reasonable thresholds by which to establish 1. Account dormancy and 2. Concentration of supply. True, the definition of both qualities will ultimately be arbitrary. As such, these definitions are occasionally reviewed

- In the meantime, we can conclude that accounts deemed to be above average dormancy and supply concentrations are likely to be owned by long-term holders, including ‘whales’, founders, foundations and institutions, and that therefore, the accounts probably contain supply that will not be available for trading any time soon

- To be sure, there are appropriate exemptions. These include ‘aggregated’ accounts (likely to relate to exchanges) and pooled balances of accounts engaged in smart contract protocols. Again, these are ascertained as accurately as possible by means of blockchain analytics. Any discovered instances like those outlined will be excluded from dormancy and concentration considerations

- Finally, the entire painstaking process enables us to establish distinct formulae for cryptocurrency market capitalisation:

- Full Market Capitalisation = Total Fungible Supply * Prevailing Price

- Free Float Market Capitalisation = Total Supply Likely to be Available for Trading * Prevailing Price

Again, it’s worth stressing that we have provided just a summary of the calculations, analyses and other evaluations undertaken to produce qualified determinations of crypto free float market cap. Also, that these are just one aspect of a barrage of measures inherent in CF Benchmarks’ methodology, the ultimate aim of which is price integrity.

After the FUD has passed in short order—as it usually does—CF Benchmarks’ methodology will have crypto market capitalisation and a host of other thorny issues, covered.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Ken Odeluga