Jul 09, 2023

CF Benchmarks Newsletter - Issue 57

Admin

Leading with ‘admin’ is normally inadvisable. Still, right now isn’t entirely ‘normal’ in our specific corner of institutional investment management. There are some positive reasons why: It’s unusual for administrative minutiae to become as central to this closely watched sphere as they have of late. Plus, the latest twists and turns of applications to list the first U.S. spot Bitcoin ETF have moved further and further ‘inside baseball’, resulting in increasingly opaque, and frankly, sometimes muddled, reporting. Some clarification seems in order, in case needed.

101

When an issuer, like an asset manager, moves ahead with a plan to list an investment product in the U.S., this typically leads to the creation of two distinct paper trails with the SEC. On the issuer side, the trail begins with the literal application, or ‘filing’ (form S-1). This generally gives the name, issuer and purpose of the proposed fund, together with details of investment goals, ancillary service providers, and more. On the exchange side, the trail begins with a Proposed Rule Change, (form 19b-4.) Because regulated exchanges are ‘rulemaking’, AKA Self-Regulatory Organizations. Rules can govern which securities they list. In effect, this makes the 19b-4 trail a separate aspect of the approval process, during which the SEC considers whether or not sufficient or accurate information has been submitted to accompany the application. Any public comments are also considered.

This means certain news reports implying recent Bitcoin ETF applications were ‘rejected’ are not quite accurate.

(For instance, this WSJ.com article where the SEC aired its view that more information was needed for applications like the one for BlackRock’s iShares Bitcoin Trust, supported by CFB’s BRRNY index)

- That’s because the application process, is well, a process. The SEC seeking further information is common and quite normal, with no bearing at this stage on the success or failure of the application

- It’s also worth noting which counterparty received the request for additional information. In all cases so far, it’s been the exchange. That’s important because it spotlights that the commission queried an aspect of the application, rather than the entire filing

Several such requests and resubmissions have come to light in recent days: by Nasdaq on behalf of BlackRock, another Nasdaq resubmission on behalf of Valkyrie, and five by the Cboe for applicants including Ark, WisdomTree and Invesco. There are no S-1 refiles here.

SSA replay

The resubmissions aim to respond to the SEC’s call for clarification of Surveillance Sharing Agreements (SSAs). We outlined what these are and why they’ve become so crucial for the bids to list the first U.S. spot BTC ETF in last week’s Newsletter. It appears the commission was keen for exchanges to disclose Coinbase, Inc. as their SSA partner, as now cited in all resubmitted forms 19b-4.

As we also noted last week, CF Benchmarks is obligated by condition of regulatory authorization to operate full look-through surveillance of the stringently selected CF Constituent Exchanges that are sole contributors to our regulated benchmarks. Therefore, BTC ETF applicants citing the CME CF Bitcoin Reference Rate – New York Variant (BRRNY) for NAV calculation have a built in additional dimension of surveillance sharing. An implicit yet material layer of oversight amenable to official purview if required. It should count.

Click below to watch an interview of CF Benchmarks CEO Sui Chung on Bloomberg TV’s crypto show.

As Chung notes, he’s “very optimistic” the SEC will approve Bitcoin ETF applications utilizing our BRRNY benchmark due to the measures outlined above.

Markets: Unreliable support

For weeks now we’ve highlighted signs of inertia exhibited by Bitcoin following a strong surge of optimistic momentum in the wake of the recent wave of spot BTC ETF filings. Well, we've just had was another one of those weeks, as shown by the daily intervals chart of the most liquid institutional Bitcoin price, our CME CF Bitcoin Real Time Index (BRTI), below.

Yet whilst we’ve highlighted common-sense risks to year-to-date price returns so far suggested by observation of the largest capitalized cryptoasset’s technical price chart, constructive motifs in the past week’s price behaviour reduce the probability of an immediate breakdown.

Germane with other risky assets, despite inarguably high historic volatility, BTC also shows distinct periods of short-to-medium term trend following. Note current coherence of daily lows (wicks) with BRTI’s 20-day exponential moving average (EMA), a common short-term indicator.

This is visible despite the latest reversal off our ‘BTC ETF barrier’, around $30k. Likewise, whilst oscillators like the Moving Average Convergence Divergence (MACD) system (bottom panel) confirm weakening upside momentum, another rising trend is evident in the histogram depicting MACD’s progress below its ‘signal line’, pointing to another recent trend suggesting periods of weaker momentum will be relatively short-lived, and equating to shallow pullbacks.

Naturally, short-term trends are only reliable until they’re not. Bitcoin must either surpass the strengthening overhead resistance circa $30k soon, or its currently observed firm tone will become increasingly brittle.

Macro Outlook

June’s FOMC meeting minutes had highlighted a less consensus view of the central bank's "hawkish pause," with some committee members indicating they would have preferred to actually increase the target rate instead. Those details were followed by fresh jobs data in the most recent week that still showed - to the Fed's ire - the labor market to be in strong health. Persistently robust new job creation is likely vindicating the view of committee members who had wished for additional tightening.

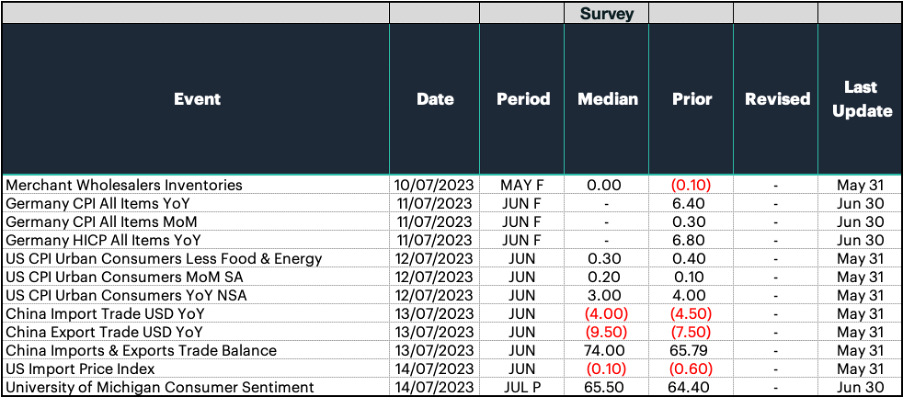

The forthcoming week's docket will provide timely insights into inflation data across the globe, starting with the latest price readings from Europe's largest economy, Germany. In the U.S., economic forecasters anticipate that headline and core inflation are likely to continue cooling, with the headline year-over-year rate falling to 3% from 4%. It is expected that food prices, housing rents, and goods prices will exert downward pressure on inflation throughout the remainder of the year. However, whether all of these factors will be enough for the Fed to reach its 2% target remains to be seen.

Gabe Selby

Featured benchmarks: CME CF Bitcoin Reference Rate • CME CF Ether-Dollar

CME's new ETH/BTC Ratio is a future whose time has come

CME Group is continuing the recent faster cadence of expansion of its suite of crypto derivative contracts with its first ratio product: Ether/Bitcoin Ratio Futures. Like all crypto contracts offered by the world's largest derivatives marketplace, Ether/Bitcoin Ratio Futures will settle to regulated cryptocurrency reference rates published and administered by CF Benchmarks, in this case, our CME CF Bitcoin Reference Rate (BRR) and CME CF Ether-Dollar Reference Rate.

This means that just like all other CME cryptocurrency derivative contracts, ETH/BTC Futures are secured by the end-to-end regulation inherent in the CME’s CFTC-regulated trading venue, and CFB’s regulated benchmark methodology.

Pending regulatory approval, this new contract will be available to trade from July 31st.

Why now

The advent of CME Ether/Bitcoin Ratio Futures might appear to be a novel turn within the context of the venue’s other contracts providing crypto exposure, each of which are instruments structured around single assets. However, rationales driving the creation of the ETH/BTC ratio future are cogent with the evolution of demand for exposure to the two largest cryptoassets by market capitalization.

As CME notes here:

“Bitcoin and Ether, the two largest cryptocurrencies by market cap, are highly correlated. As the relative strength of the correlation fluctuates, market idiosyncrasies may affect one coin more so than the other creating trading opportunities.”

ETH vs. BTC

In other words, the principal facility offered by the ETH/BTC ratio is the ability to execute a relative value trade of the kind commonly undertaken by institutional capital markets participants. This makes the ratio an ideal way to express a perspective on the blockchain economic outlook of Bitcoin and Ether, particularly with regards to adoption.

In ‘classic’ relative value trades executed through a ratio structure, for instance, the silver/gold ratio, the participant generally expects one side of the ratio to predominate over a certain period of time, as it responds to macroeconomic or market-specific developments that may have a negative or positive impact on the price of one or both ratio assets.

Likewise, Ether/Bitcoin Ratio Futures may be expected to reflect the impact of dominant developments important to these blockchains. For instance, the probability of the first U.S.-listed spot crypto ETF being one that invests in Bitcoin, vs. the probability that it’s an Ether ETF. Or perhaps certain traders may deploy the ratio to exploit a strong view (and optimistic timing) of the so-called ‘flippening’, or the short-term impact of Bitcoin’s next ‘halving’, among other potential scenarios.

How it works

Technically speaking, the ratio is predictably defined as the price of the CME’s Ether Futures divided by the price of CME Bitcoin Futures. Likewise, settlement is determined by the division of the Ether Futures Final Settlement Price (based on our CME CF Ether-Dollar Reference Rate) by the CME Bitcoin Futures Final Settlement Price (the latter based on CME CF BRR). Expiration months will be identical and the ratio will always be positive.

Find out more about the CME’s forthcoming Ether/Bitcoin Ratio Futures

Featured benchmark: CF Bitcoin New York TWAP

VIDEO: CFB Talks Digital Assets Episode 13: The Outlook for Institutional Crypto Adoption - with Peter Stern

We're excited to present Peter Stern, our Director of Sales & Business Development, as our guest on CFB Talks Digital Assets, for a timely conversation about institutional crypto adoption – particularly by asset managers looking to list spot crypto ETFs...

In many ways, Peter has one of the most difficult jobs in digital assets: selling crypto indices to regulated, notoriously conservative institutions in the Americas! But it’s a job he’s evidently excelled at.

As we’ve seen, forward-thinking institutions are beginning to make big strides into adoption.

But it takes individuals with considerable skill, knowledge of blockchain economics and traditional finance + patience, to encourage institutions to take that first step.

- Watch our stimulating conversation to hear how Peter spearheads CFB’s relationships with some of the most preeminent financial institutions, including BlackRock, which launched BlackRock Bitcoin Private Trust last year.

- Why the institutional focus is likely to remain on Bitcoin and Ether for now

- How, backed with safeguards built into our regulated indices, Peter plays a major part in driving home the importance of information sharing for listed crypto funds

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks

Gabriel Selby