Jul 26, 2024

CF Benchmarks Newsletter - Issue 68 - Ether ETF Launch Edition

- ETH ETFs surprise moderately to the upside

- What existing ETH fund data suggest about the outlook for flows

- Day One takeaways

Done

Within historical bounds, but better than many optimists expected.

With first-day turnover at a respectable $1 billion, and net inflows around $107m, that’s about as even-handed a thumbnail as you’re likely to get about the launch of the Ethereum ETFs, at the beginning of trading this week, after possibly one of the most byzantine regulatory approval processes for any new offering.

Too low

If you’ve been among reasonably interested observers of the train of events, you’ll be aware analysts adventurous enough to speculate on early flows have generally fallen into two camps: the moderately optimistic, and the somewhat pessimistic.

The U.S. spot Bitcoin funds listings in January literally set records for the fastest asset growth in the history of ETFs, at the individual fund level, for the CME CF BRRNY-powered iShares Bitcoin Trust (IBIT), and consequently, by the new product class as a whole.

No one expected this week’s Ether fund debut’s to anywhere near match that.

But low-ball expectations were also predicated, somewhat justifiably on the even more obvious and reasonable, dynamic of Ether being the No. 2 cryptoasset, by market capitalisation, implying structurally lower demand.

Finally, many forecasters latched on to the flow performance of spot Ether ETFs vs. spot BTC ETFs in what seemed like a decent ‘naturally occurring’ scenario for a side-by-side comparison, when both sets of funds were launched simultaneously in Hong Kong, a few months ago.

CF Benchmarks’ Head of Research, Gabe Selby, CFA notes a volume breakdown in initial HK trading sessions of approximately 15%-85% in favour of the larger asset, Bitcoin.

Realistic + Optimistic

Our general house view has for some time been that the greater complexities of the Ethereum network, compared to Bitcoin, due to its wider range of facilities as the largest programmable layer 1 blockchain, should contribute to a ‘tougher lift’ in terms of adoption within the ETF wrapper, and ultimately, asset gathering.

For a succinct explanation of that aspect, watch the clip below, from the Ether ETF launch edition of our CFB Talks Digital Assets podcast, featuring CF Benchmarks CEO Sui Chung.

Clip from Episode 29 of CFB Talks Digital Assets, featuring CFB CEO Sui Chung

Scroll down to read the episode intro and find a link to the complete show.

Upside pointers

That said, from our perspective, there was plenty of objective backing for more quietly optimistic expectations. And as we’ll see, the launch played out pretty close to these rosier expectations, even if spot Ether ETF assets have not dramatically accelerated out of the gate in any way comparable to the BTC fund debuts – which no one realistically expected anyway.

Looping back to the CF Benchmarks research team’s perspective again, Gabe notes Ether’s approximately $360bn market cap is roughly a third of Bitcoin's circa $1 trillion. However, historically, looking at extant Ether fund asset distributions, Ether has consistently lagged expectations calibrated to its free floating market capitalisation.

Ether fund assets currently sit around $12.8bn, notes Gabe, vs. $64bn in comparable Bitcoin fund assets, equating to a global fund share for Ether of about 20%. All that suggests a cohort of excessive caution among some forecasters.

All in, despite the slower start of the second crypto asset to reach Wall Street, even Ether's more modest indicative fund distribution profile suggests the most pessimistic expectations on flows may prove to be undercooked, especially over time.

Day one takeaways

ETHE echoes GBTC

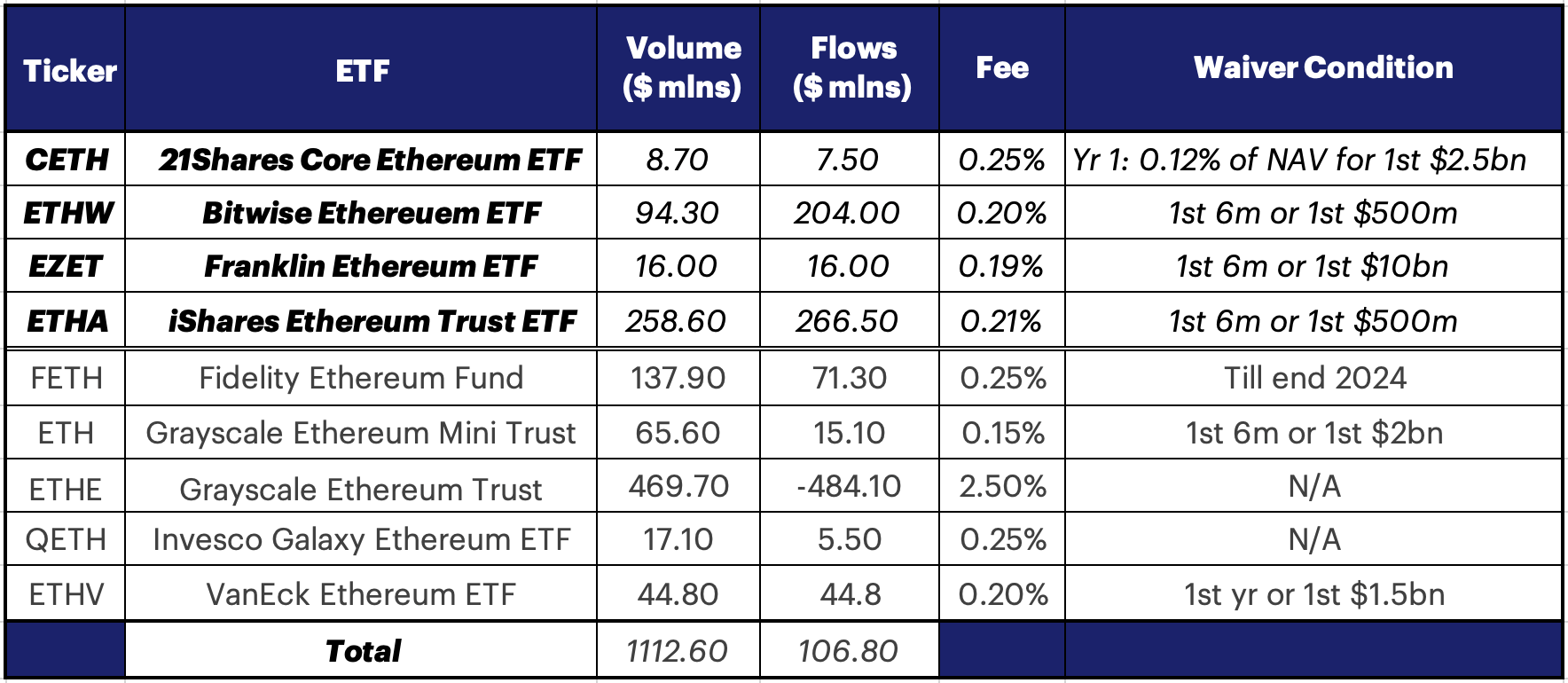

As shown above, despite more modest gross volumes on their first day of trading, in many ways, Ether’s ETF debut still echoed BTC ETFs’ first day.

For one thing, there was a similar centrifugal effect on flows exiting the only fund converting from an existing OTC vehicle, into an ETP, Grayscale's ETHE.

Plus, given Grayscale’s decision to follow a similar pragmatic playbook as it did for GBTC, right down to maintaining a higher management fee than rivals, ETHE’s outsize turnover contribution was largely attributable to the same reason as we saw in January, and in the same direction.

Meanwhile, by launching a ‘mini-ETHE’, Grayscale deployed the structure often executed by issuers managing established funds with notional barriers to entry; offering a ‘spin-off’ intended to be cheaper to transact, and perhaps more accessible.

Here’s an X/Twitter thread containing an excellent explanation of the structure and rationale of Grayscale’s ETHE and ETH set-up, by Bloomberg ETF analyst James Seyffart.

ETHUSD_NY dominance likely

On the stronger side, BlackRock’s ETHA predictably saw the leading inflow momentum.

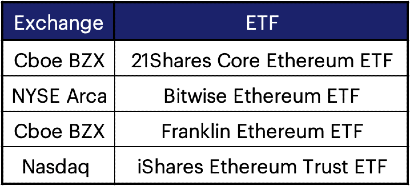

Together with Bitwise’s ETHW, and the contribution from 21Shares’ CETH and Franklin’s EZET, assets referencing our CME CF Ether-Dollar Reference Rate – New York Variant (ETHUSD_NY) will almost certainly exert the biggest influence on total Ether ETF market share, just like its Bitcoin counterpart benchmark, BRRNY, which remains the reference price for around 60% of BTC ETF product class.

Naturally, a more definitive share of ETHUSD_NY assets referenced will become clearer after the new funds rack up more trading days.

Below, we reproduce an excerpt of our Ether ETF launch day post, outlining the background to this latest crypto inflection point.

CF Benchmarks-supported Spot Ether ETFs go Live

The second spot crypto ETF saga of the year is finally over

Following the surprising turn of regulatory events in recent months, what was already a remarkable year for digital asset adoption is now an even bigger one.

After a few weeks of uncertainty following the SEC’s approval order for Ether ETF exchange filings (19b-4s), the Commission has finally rubber-stamped the issuer ETF applications, mostly S1s (and some variants) enabling the proposed funds to ‘go effective’.

Most are expected to begin trading within Tuesday's U.S. market session.

The CFB-powered ETH ETFs

For CF Benchmarks, of course, this second inflection point for digital asset adoption within six months is - again - all the more consequential because of the swathe of high profile issuers opting to use another of our regulated benchmarks for NAV calculation.

For Ether ETFs, it's this one:

CME CF Ether-Dollar Reference Rate – New York Variant (ETHUSD_NY)

And here are the ETFs utilising ETHUSD_NY as their benchmark:

Why ETH ETFs are as important as BTC ETFs

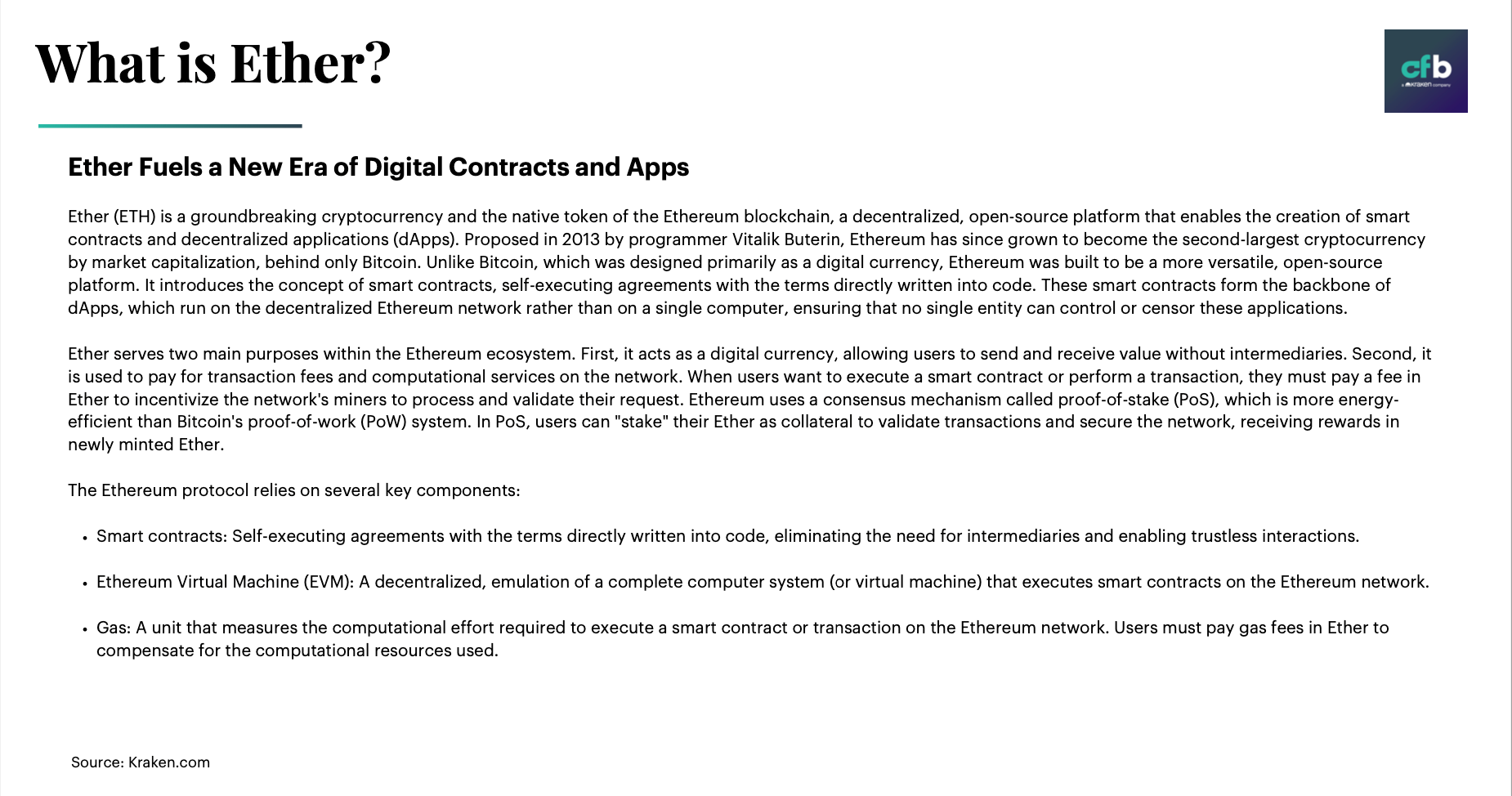

Meanwhile, it’s worth noting that Ethereum’s ‘No. 2’ status among digital assets, relative to Bitcoin, has encouraged some to assume that this follow-on development is of lessor importance than the listing of spot Bitcoin ETFs, earlier this year.

Whilst Ethereum’s secondary position to Bitcoin in market capitalisation terms is an objective fact, there are sound reasons why such views may need to be tempered.

Aside from the very obvious one that Ethereum ETFs represent only the second asset in the digital asset class to be offered within the ETF wrapper in the U.S., the green light from the SEC that brought this about has broader significance.

Chiefly because the regulatory approval of Ether ETFs clarifies core principles that reach beyond the first two digital assets to receive the ETF treatment.

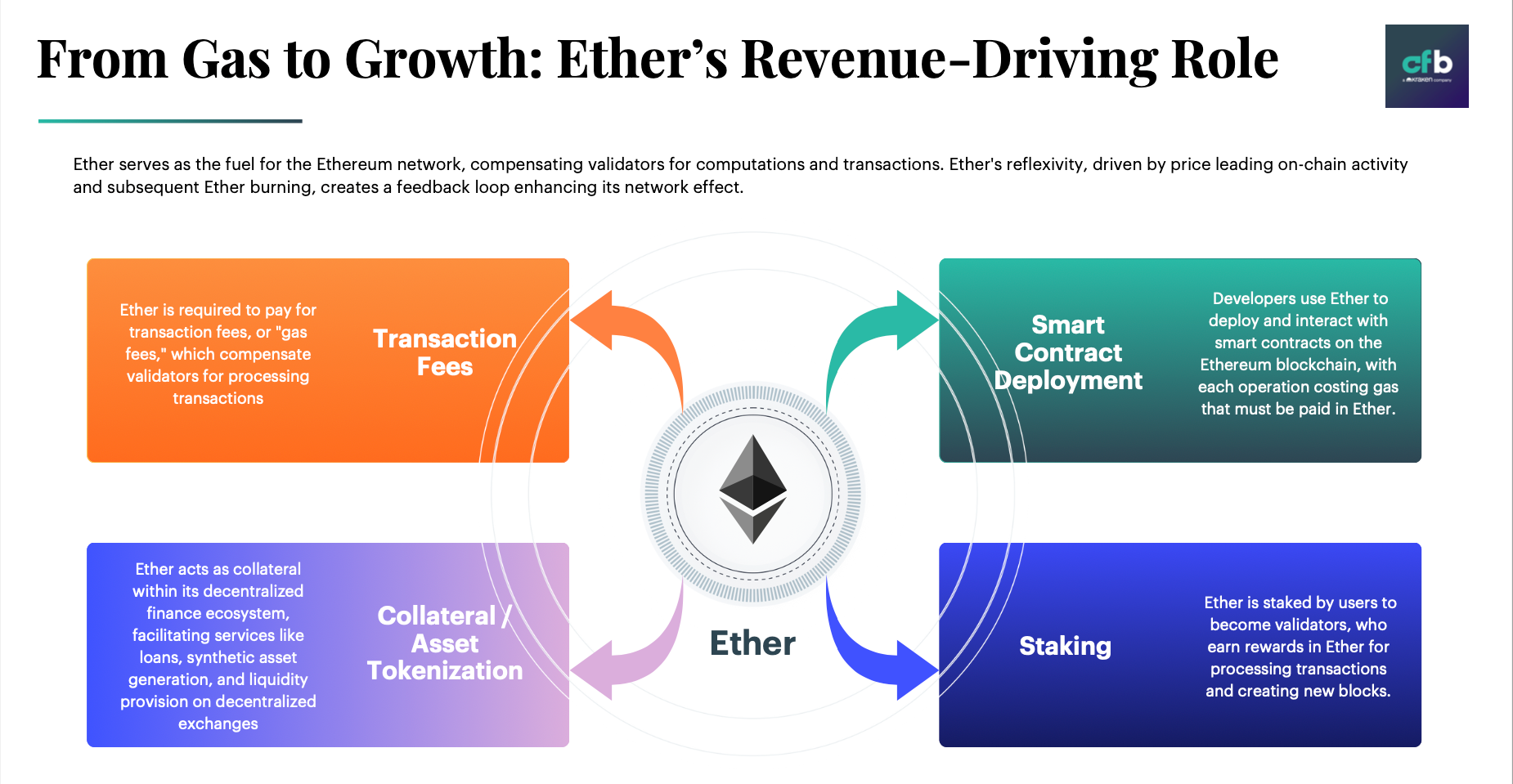

Note that Ethereum’s architecture and ecosystem are more attenuated than Bitcoin’s, indicating greater complexity, and in turn, a potentially steeper learning curve for mass understanding.

Just as importantly, means of user participation with the Ethereum network are far more varied than methods of interacting with Bitcoin.

Despite these differences though, the regulatory case for Ethereum ETF approval still largely pivoted on the status of its native token, Ether, as a commodity.

Click below to read the rest of this post.

CFB Talks Digital Assets Episode 29: The Ether Investment Case and what the ETF approvals say about regulatory changes, with Sui Chung

Spot Ether ETFs are finally here!

Just like for Bitcoin ETFs though, the path to approval has been full of suspense and drama.

Whether it was SEC chair Gary Gensler's stated view that Ether is a security; the controversy over staking, or regulatory action against certain crypto platforms, the process often felt like it was one plot twist away from complete shut down.

With four of these new funds using our regulated ETHUSD_NY index to calculate Net Asset Value (NAV) - once again, CF Benchmarks has had a ringside seat.

To find out what we learned, join CF Benchmarks CEO Sui Chung, Head of Content Ken Odeluga, and Head of Research Gabe Selby, CFA, for an extra special episode of the CFB Talks Digital Assets podcast.

- Hear how the SEC abruptly dropped opposition to ETH ETFs - weeks after receiving our analyses

- The SEC also cited CF Benchmarks by name in its approval order - but did we really change the regulator's mind?

- How filings changed over time to meet SEC expectations; offering clues on possible future crypto ETF approval criteria

- Get Gabe's data-driven analysis of why ETH ETF inflow forecasts might be undercooked

Listen on Spotify

Listen on Apple Podcasts

Watch on YouTube

Watch on Vimeo

Below we feature a summary and excerpts from the definitive Ethereum Primer recently published by the CF Benchmarks Research team Gabriel Selby, CFA and Mark Pilipczuk.

Excerpted from a report by Gabriel Selby, CFA and Mark Pilipczuk

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks

Gabriel Selby