Jul 23, 2024

CF Benchmarks-supported Spot Ether ETFs set to go Live

The second spot crypto ETF saga of the year is finally over

Following the surprising turn of regulatory events in recent months, what was already a remarkable year for digital asset adoption is now an even bigger one.

After a few weeks of uncertainty following the SEC’s approval order for Ether ETF exchange filings (19b-4s), the Commission has finally rubber-stamped the issuer ETF applications, mostly S1s (and some variants) enabling the proposed funds to ‘go effective’.

Most are expected to begin trading within Tuesday's U.S. market session.

The CFB-powered ETH ETFs

For CF Benchmarks, of course, this second inflection point for digital asset adoption within six months is - again - all the more consequential because of the swathe of high profile issuers opting to use another of our regulated benchmarks for NAV calculation.

For Ether ETFs, it's this one:

CME CF Ether-Dollar Reference Rate – New York Variant (ETHUSD_NY)

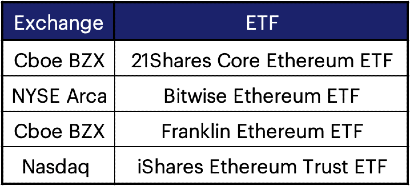

And here are the ETFs utilising ETHUSD_NY as their benchmark:

Why ETH ETFs are as important as BTC ETFs

Meanwhile, it’s worth noting that Ethereum’s ‘No. 2’ status among digital assets, relative to Bitcoin, has encouraged some to assume that this follow-on development is of lessor importance than the listing of spot Bitcoin ETFs, earlier this year.

Whilst Ethereum’s secondary position to Bitcoin in market capitalisation terms is an objective fact, there are sound reasons why such views may need to be tempered.

Aside from the very obvious one that Ethereum ETFs represent only the second asset in the digital asset class to be offered within the ETF wrapper in the U.S., the green light from the SEC that brought this about has broader significance.

Chiefly because the regulatory approval of Ether ETFs clarifies core principles that reach beyond the first two digital assets to receive the ETF treatment.

Note that Ethereum’s architecture and ecosystem are more attenuated than Bitcoin’s, indicating greater complexity, and in turn, a potentially steeper learning curve for mass understanding.

Just as importantly, means of user participation with the Ethereum network are far more varied than methods of interacting with Bitcoin.

Despite these differences though, the regulatory case for Ethereum ETF approval still largely pivoted on the status of its native token, Ether, as a commodity.

How Ether ‘became' a commodity

Again, as per the Bitcoin inflection point, it’s cogent at this point to offer a concise account of CF Benchmarks’ important role in the approval of U.S. spot Ether ETFs.

Just like for Bitcoin ETFs, the history of Ether ETF applications to the SEC closely tracks CFB’s involvement, with many of our clients among the first firms to propose such vehicles in the U.S.

The part we have typically played is to lend the benefit of our experience in regulatory affairs and expertise in devising Benchmarks Regulation (BMR) compliant indices, the standard that is synonymous with integrity, robustness and replicability.

Note that partially parallel with the grinding progress of such proposals in the U.S., CF Benchmarks’ regulated benchmark methodology has underpinned successful approvals of spot Ether based exchange traded products (ETPs) in regulatory jurisdictions around the world, including Europe, Canada and Brazil – though obviously at a less frustrating pace!

You can find out more about the global spot Ether funds utilising our regulated benchmarks from our ETF page.

Now, CF Benchmarks is now proud to witness the culmination of lengthy efforts in close collaboration with our partners, to get spot Ether funds listed in the U.S.

The extended role of CF Benchmarks

Furthermore, CF Benchmarks’ contribution is documented to have been even more pivotal.

As we explain in detail here and here, CF Benchmarks’ analysis, data and commentary are cited within the SEC order enabling stock exchanges to list spot Ether ETFs.

For one thing, it is unprecedented for the SEC to cite a commercial third party, by name, in an ETF approval order - as far as we’re aware – (please see below).

For another, the unexpected reversal of the Commission’s previous well-known stance on Ether ETFs is also pretty massive!

About that flip...

Even more remarkable is the switch of the SEC’s opinion on Ether’s commodity status to a stance aligned with CFB’s view – that Ethereum was, in effect, already recognised by U.S. regulators as a commodity.

The SEC was widely known previously to object to that designation

Read ‘SEC cites CF Benchmarks in ETH ETF Pivot’ for more details.

Although the Commission has studiously avoided confirmation of this shift in its stance, the launch of Ether ETFs on U.S. exchanges speaks for itself.

We wish our Ether ETF clients every success!

Click below to read or download the CF Benchmarks Research team white paper ‘Ether: A strategic Asset for the Decentralized Economy’.

This is a comprehensive, in-depth primer on Ethereum as an investment asset, exploring its basis as the foundational network for smart contract platform functionality.

Key themes

- Interoperability of layer-2 blockchains based on Ethereum

- Ethereum ‘tokenomics’ - AKA its blockchain economic model

- The fundamental rationale that provides Ethereum with undeniable intrinsic value

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks

Gabriel Selby