Sep 09, 2024

Weekly Index Highlights, September 9, 2024

CFB's Weekly Index Highlights provides a brief summary of the performance of our market-leading reference rates and indices for the period September 2, 2024 to September 8, 2024.

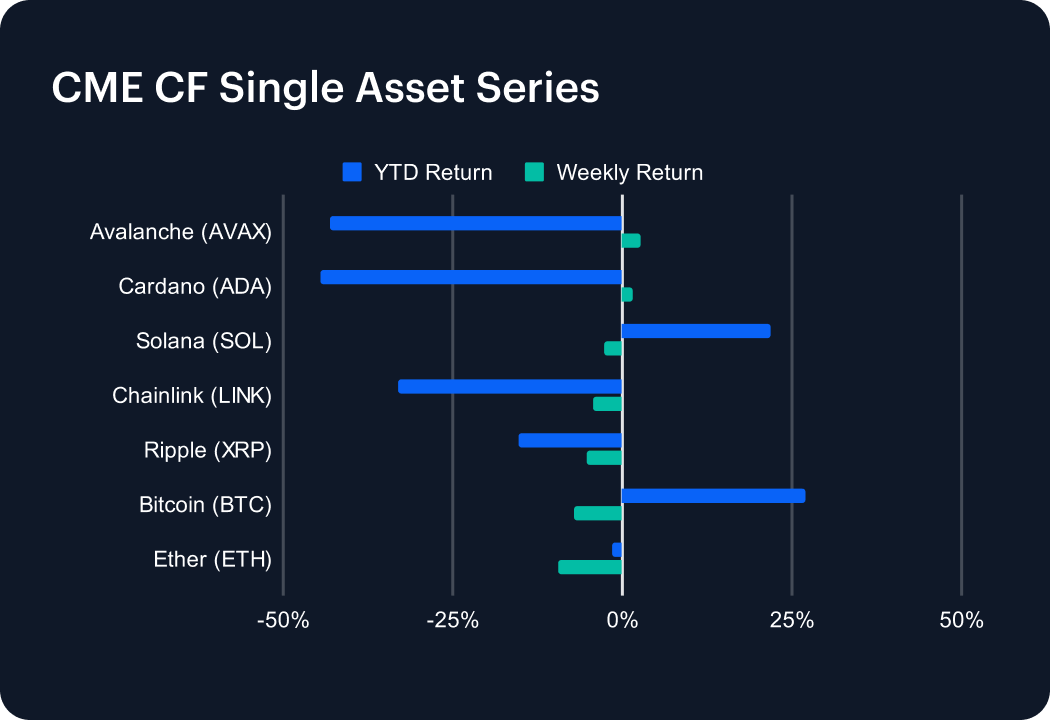

Ether led the large cap retreat (-9.36%) as it joins other tokens with a negative return YTD (-1.47%), leaving only Solana (+21.78) and Bitcoin (+26.93%) higher YTD.

The Finance sub-category’s recent relative outperformance faded (-3.94%) despite fair gains by 1INCH (+7.36%), UNI (+5.28%) and SUSHI (+1.68%). Meanwhile, APE’s +24.98% jump wasn’t enough to lift the Culture sub-category, leaving it down -1.49% for the week.

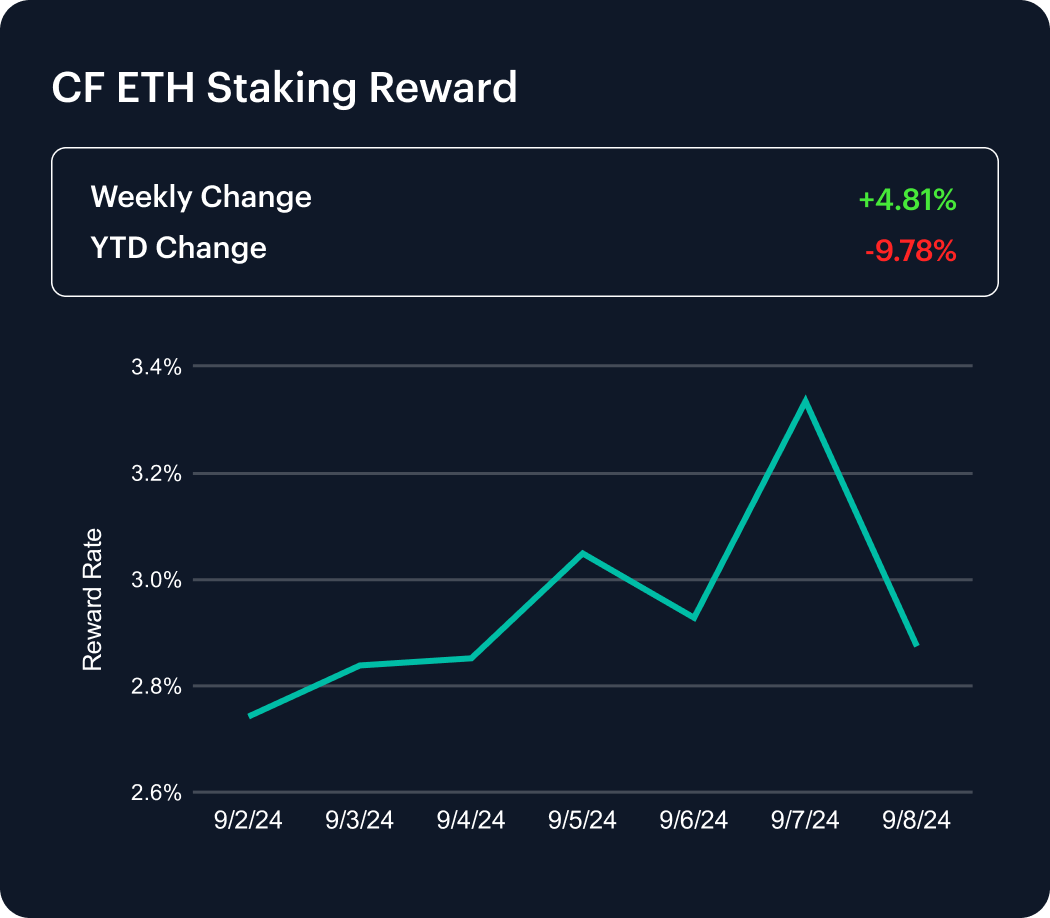

Ether's staking rewards have managed to reduce their YTD fall to just under -10% (-9.78) with a weekly return of +4.81%.

The overall challenging price environment equated to negative returns for all large cap indices. However, a slight YTD underperformance by the CF Broad Cap Index suggests key weakness in this series stems largely from outside the mega caps.

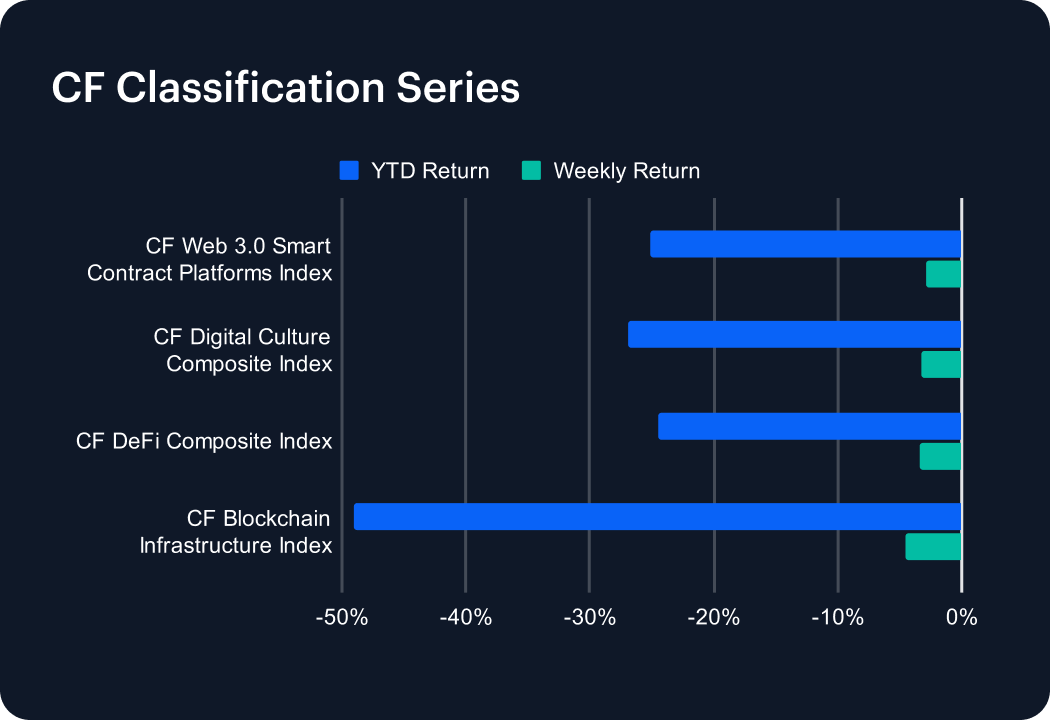

All CF Classification Series indices declined, though the CF Blockchain Infrastructure Index’s moderately weaker weekly underperformance than others (-4.56%) maintains its position as the worst performer YTD.

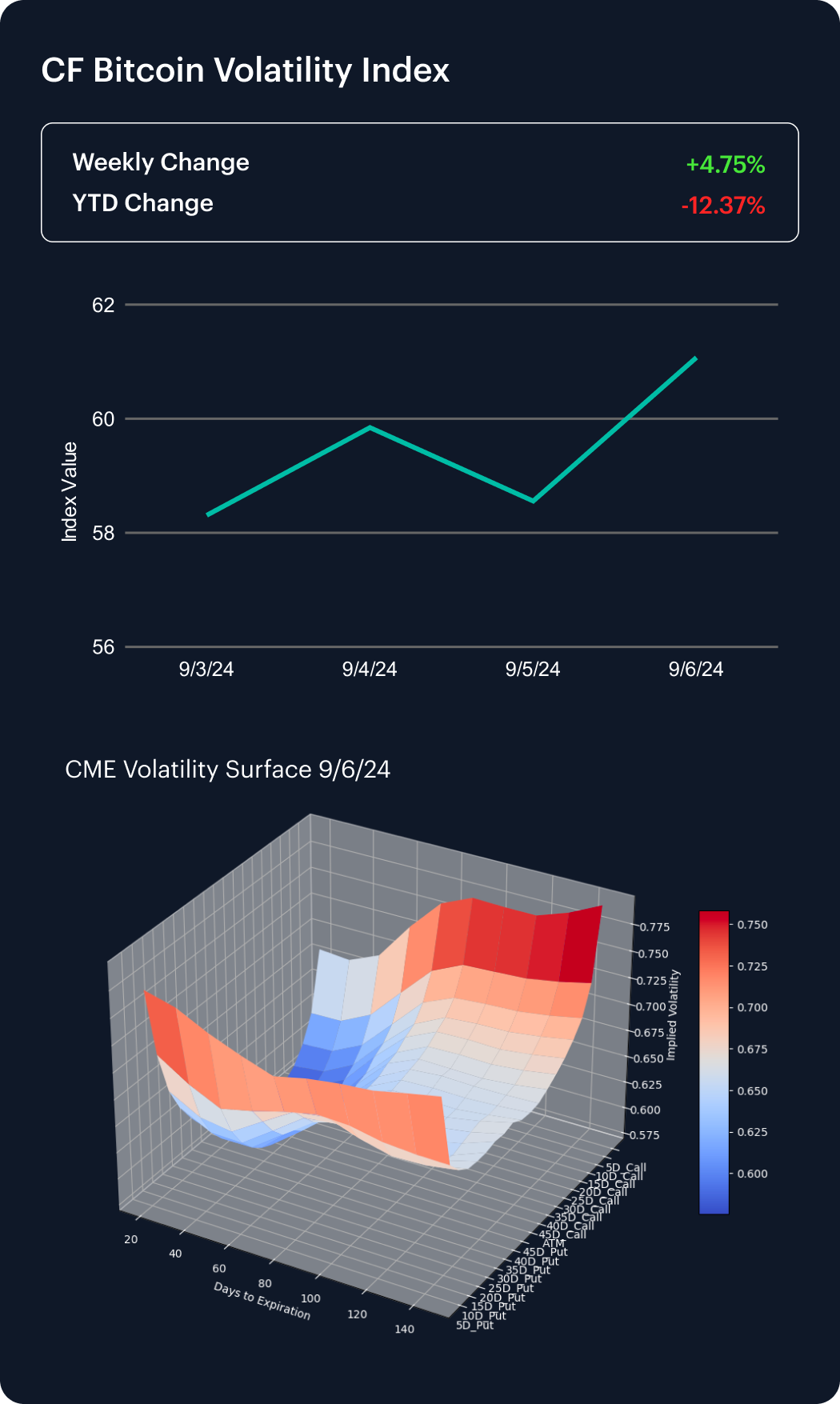

Bitcoin trimmed its moderately downward implied volatility trend (now -12.37% YTD) with a weekly rise of +4.75%.

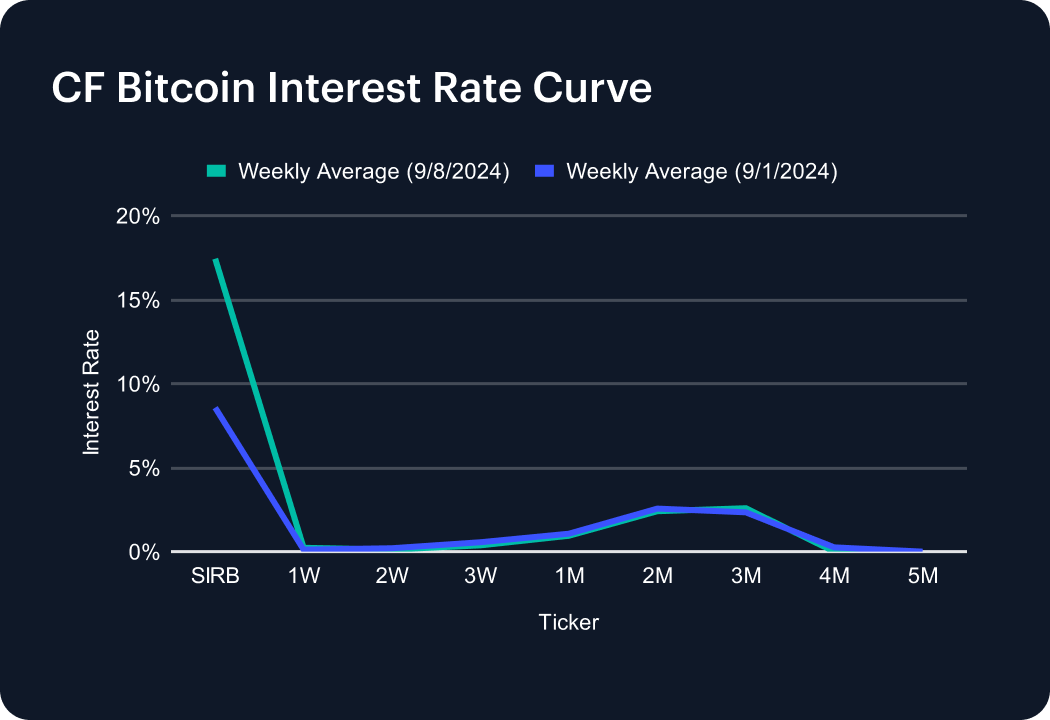

The curve’s current flattening dynamic is reflected by the negative pricing sentiment currently evident in the market.

Index data based on CF Benchmarks Settlement Rates, published at 16:00 London Time

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Ken Odeluga

CF Benchmarks

Gabriel Selby